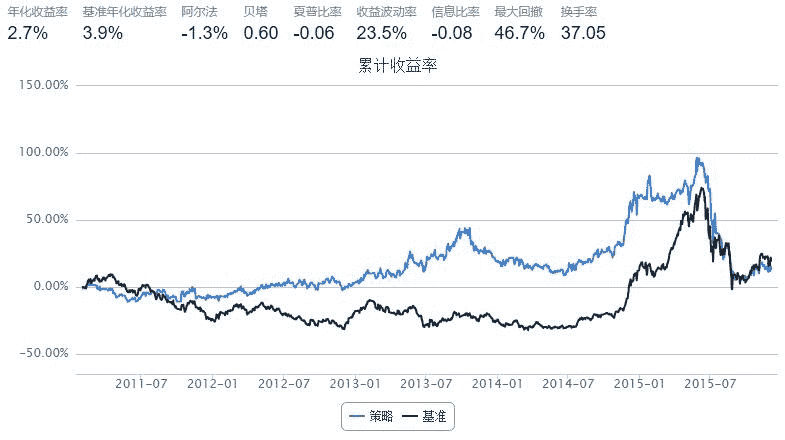

最经典的Momentum和Contrarian在中国市场的测试-yanheven改进

来源:https://uqer.io/community/share/5663f369f9f06c6c8a91b3af

Momentum

策略思路

- Momentum:业绩好的股票会继续保持其上涨的势头,业绩差的股票会保持其下跌的势头

策略实现

- Momentum:每次调仓将股票按照前一段时间的累计收益率排序并分组,买入历史累计收益 最高 的那一组

start = datetime(2011, 1, 1) # 回测起始时间

end = datetime(2015, 12, 5) # 回测结束时间

benchmark = 'HS300' # 使用沪深 300 作为参考标准

universe = set_universe('HS300') # 股票池,沪深 300

capital_base = 100000 # 起始资金

refresh_rate = 10

def initialize(account): # 初始化虚拟账户状态

pass

def handle_data(account): # 每个交易日的买入卖出指令

history = account.get_attribute_history('closePrice', 20)

momentum = []

holding = account.valid_secpos

for stk in history:

if stk in account.universe:

his = history[stk]

change = his[-1] / his[0]

momentum.append((stk, change))

momentum = sorted(momentum, key=lambda x: x[1])

momentum = momentum[:10]

momentum_list = [i[0] for i in momentum]

buy_list = set(momentum_list) - set(holding)

sell_list = set(holding) - set(momentum_list)

for i in buy_list:

try:

order_pct_to(i, 0.1)

except Exception as e:

log.warn(i + str(e))

for i in sell_list:

order_to(i, 0)

Contrarian

策略思路

- Contrarian:股票在经过一段时间的上涨之后会出现回落,一段时间的下跌之后会出现反弹

策略实现

- Contrarian:每次调仓将股票按照前一段时间的累计收益率排序并分组,买入历史累计收益 最低 的那一组

start = datetime(2011, 1, 1) # 回测起始时间

end = datetime(2015, 12, 5) # 回测结束时间

benchmark = 'HS300' # 使用沪深 300 作为参考标准

universe = set_universe('HS300') # 股票池,沪深 300

capital_base = 100000 # 起始资金

refresh_rate = 10

def initialize(account): # 初始化虚拟账户状态

pass

def handle_data(account): # 每个交易日的买入卖出指令

history = account.get_attribute_history('closePrice', 20)

momentum = []

holding = account.valid_secpos

for stk in history:

if stk in account.universe:

his = history[stk]

change = his[-1] / his[0]

momentum.append((stk, change))

momentum = sorted(momentum, key=lambda x: x[1], reverse=True)

# if momentum[-1][1] < 1:

# log.info(holding)

# for i in holding:

# order_to(i, 0)

# # return

momentum = momentum[:10]

momentum_list = [i[0] for i in momentum]

buy_list = set(momentum_list) - set(holding)

sell_list = set(holding) - set(momentum_list)

for i in buy_list:

try:

order_pct_to(i, 0.1)

except Exception as e:

log.warn(i + str(e))

for i in sell_list:

order_to(i, 0)