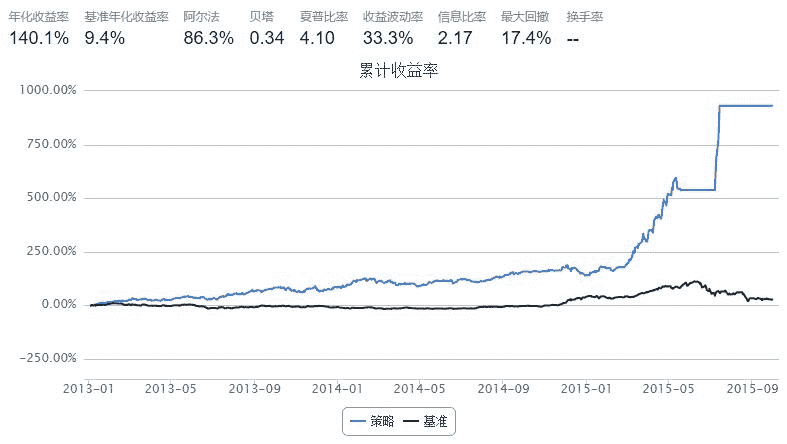

5.5 钟摆理论 · 钟摆理论的简单实现——完美躲过股灾和精准抄底

今天给大家简单介绍一种稳健的投资体系——钟摆理论的量化模型实现。这里要感谢@进化论一平 的雪球分享:http://xueqiu.com/8510627167/29759691

其中的核心思想是: (1)从买入操作来看:通过找到有效价格区间,要求在价格低估时买入,但这同时又要满足另一个条件,那就是趋势必须向上。二者缺一不可。 (2)从卖出操作来看:必须顺势而为,在价格超过有效价格区间以后,如果趋势不变,不要急于卖出,直到趋势改变,价格高估再卖出。二者同样缺一不可。

那么核心问题就是两个: (1)如何找到有效的价格区间?也就是,如何给出个股的估值?(2)怎样判断趋势?

为了尽量追求简单,避免太复杂的优化。我这里直接给出两个问题的简单判定方法。

(1)根据格雷厄姆的成长价值公式进行估值,并且根据A股的实际情况或者市场情绪给予一定溢价或者折价。价值=当期(正常)利润×(8.5 + 两倍的预期年增长率),其中的当期利润使用每股收益EPS进行衡量,预期年增长率使用EGRO/5表示,其中EGRO的计算方法为5年收益关于时间(年)进行线性回归的回归系数/5年收益均值的绝对值

(2)判断趋势有两种途径结合,一种是趋势已经向上,比较简单判断方法是五日线在十日线之上(这种判断方法犯错的几率较大,读者可以自行改进),另外一种是趋势由下向上逆转,即出现明显的底部形态。关于后者,我给出的判断标准为:股价相对于近期高点大幅下跌超过downPercent(例如30%),并且收盘价在五日线十日线之下,并且收红或者收星,跌幅小于7%

接下来就是具体实现了。

def preceding_date(date):

cal = DataAPI.TradeCalGet(exchangeCD=u"XSHG",beginDate='20110101',endDate=date,field=['calendarDate','isOpen'],pandas="1")

cal = cal[cal['isOpen']==1]

date = cal['calendarDate'].values[-2].replace('-','')

return date

def duotou_5_10(date, stockList, precedingDate=True):

if precedingDate:

date = preceding_date(date)

duotou = {}

if stockList is None or len(stockList) == 0:

return duotou

kLine = DataAPI.MktStockFactorsOneDayGet(tradeDate=date,secID=stockList,field=['secID','MA5','MA10'],pandas="1")

kLine = kLine.dropna()

for stock, ma5, ma10 in zip(kLine['secID'].values, kLine['MA5'].values, kLine['MA10'].values):

if ma5 > ma10:

duotou[stock] = True

else:

duotou[stock] = False

return duotou

def spreadRateByIntrinsicValue(account, overflow=0.0, precedingDate=True):

stock_list = account.universe

current_date = account.current_date

date = current_date.strftime('%Y%m%d')

if precedingDate:

date = preceding_date(date)

eq_EPS_EGRO = DataAPI.MktStockFactorsOneDayGet(tradeDate=date,secID=stock_list,field=['secID','EPS','EGRO'],pandas="1")

eq_EPS_EGRO['Value'] = eq_EPS_EGRO['EPS']*(8.5+2*eq_EPS_EGRO['EGRO']/5)

eq_EPS_EGRO = eq_EPS_EGRO.dropna()

spread_rate = []

for stock, intrinsic_value in zip(eq_EPS_EGRO['secID'].values, eq_EPS_EGRO['Value'].values):

intrinsic_value = intrinsic_value*(1+overflow)

reference_price = account.referencePrice[stock]

if reference_price > 0 and reference_price < intrinsic_value:

spread_rate.append((stock, (intrinsic_value-reference_price)/reference_price))

return sorted(spread_rate, key=lambda k: k[-1], reverse=True)

'''

判断是否为底部形态,判断标准为股价相对于近期高点大幅下跌超过downPercent,并且收盘价在五日线十日线之下,并且收红或者收星,跌幅小于7%

'''

def isButtom(date, stockList, precedingDate=True, downPercent=0.3):

cal = DataAPI.TradeCalGet(exchangeCD=u"XSHG",beginDate='20110101',endDate=date,field=u"prevTradeDate",pandas="1")

daysAhead = cal['prevTradeDate'].values[-20].replace('-','')

if precedingDate:

date = cal['prevTradeDate'].values[-1].replace('-','')

rs = {}

if stockList is None or len(stockList) == 0:

return rs

dayInfo = DataAPI.MktEqudAdjGet(secID=stockList, beginDate=daysAhead, endDate=date ,field=['secID', 'openPrice', 'closePrice', 'preClosePrice'],pandas="1")

dayInfo.dropna()

for stock in stockList:

stockDayInfo = dayInfo[dayInfo['secID']==stock]

closePrices = stockDayInfo['closePrice'].values

ma5 = np.mean(closePrices[-5:])

ma10 = np.mean(closePrices[-10:])

closePrice = closePrices[-1]

maxClosePrice = np.max(closePrices)

openPrice = stockDayInfo['openPrice'].values[-1]

preClosePrice = stockDayInfo['preClosePrice'].values[-1]

if (maxClosePrice-closePrice)/maxClosePrice > downPercent and closePrice < ma5 and ma5 < ma10 and (closePrice > openPrice or abs(closePrice-openPrice)/openPrice < 0.02) and abs(closePrice-preClosePrice)/preClosePrice<0.07:

rs[stock] = True

else:

rs[stock] = False

return rs

import numpy as np

start = '2013-01-01' # 回测起始时间

end = '2015-10-01' # 回测结束时间

benchmark = 'HS300' # 策略参考标准

commission = Commission(buycost=0.0008, sellcost=0.0018) # 佣金万八

universe = set_universe('CYB',date=end) # Very Important Here!! 选股很重要!不要玩大烂臭!估值再低也别玩!

capital_base = 1000000 # 起始资金

freq = 'd' # 策略类型,'d'表示日间策略使用日线回测,'m'表示日内策略使用分钟线回测

refresh_rate = 1 # 调仓频率,表示执行handle_data的时间间隔,若freq = 'd'时间间隔的单位为交易日,若freq = 'm'时间间隔为分钟

max_percent_of_a_stock = 1.0 # 单支股的最大仓位

def initialize(account): # 初始化虚拟账户状态

pass

def handle_data(account): # 每个交易日的买入卖出指令

global max_percent_of_a_stock

buylist = []

selist = []

current_date = account.current_date

current_date = current_date.strftime('%Y%m%d')

overflow = 0.15 # 根据情况给予一定的溢价(例如0.1)或者折价(例如-0.1),也可以根据市场风险程度进行动态调节(此处读者可以自行发挥)

spread_rate = dict(spreadRateByIntrinsicValue(account, overflow=overflow, precedingDate=True))

referencePortfolioValue = account.referencePortfolioValue

# 获取用来计算多头形态的股票列表

stock_set_for_duotou = []

stock_set_for_duotou.extend(account.avail_secpos.keys())

stock_set_for_duotou.extend(spread_rate.keys())

stock_set_for_duotou = list(set(stock_set_for_duotou))

duotou_5_10_Map = duotou_5_10(current_date, stock_set_for_duotou, precedingDate=True)

isButtom_Map = isButtom(current_date, stock_set_for_duotou, precedingDate=True, downPercent=0.3)

for stock in account.avail_secpos.keys():

if stock not in spread_rate and not duotou_5_10_Map.get(stock, False):

selist.append(stock)

for stock in selist:

sell_value = account.referencePrice[stock]*account.valid_secpos[stock]

order_to(stock, 0)

for stock in spread_rate.keys():

if stock not in account.valid_secpos:

buylist.append(stock)

for stock in buylist:

# 满足以下条件之一买入:(1)5日线在10日线之上;(2)出现底部特征

if duotou_5_10_Map.get(stock, False) or isButtom_Map.get(stock, False):

buy_value = min(referencePortfolioValue*max_percent_of_a_stock, account.cash/len(buylist))

if buy_value/referencePortfolioValue >= 0.0001:

order_pct(stock, buy_value/referencePortfolioValue)

回测可以发现,这种投资体系能够完美躲过股灾,并且能在股灾中精准抄底获利 :-)