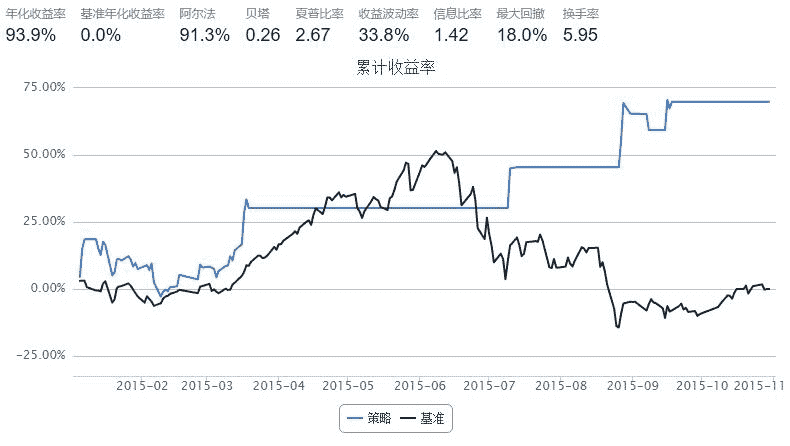

决策树模型(固定模型)

来源:https://uqer.io/community/share/568dce2d228e5b18e2ba296e

楼主上学时学的是机器学习,现在在BAT做数据挖掘,一直对将机器学习的知识应用到金融领域比较感兴趣。

最近发现了优矿这个平台之后,有点着迷了,通过看大家的策略,也学到些知识。

因为楼主对金融投资认识不多,所以写的策略比较简单粗暴,希望向大家多多学习~

策略: 1、不预测具体股价,只预测次日收盘价相比今日是涨是跌; 2、如果预测为涨,则全部买入或持有;如果预测为跌,则全部卖出。

方法: 基于某只股票的历史数据,采用机器学习的方法,挖掘其中规律,预测该只股票次日收盘价是涨还是跌

import numpy as np

from CAL.PyCAL import *

from sklearn.cross_validation import train_test_split

from sklearn.externals import joblib

import pandas as pd

cal = Calendar('China.SSE')

# 第一步:设置基本参数

start = '2015-01-01'

end = '2015-11-01'

capital_base = 1000000

refresh_rate = 1

benchmark = 'HS300'

##HS300

freq = 'd'

#601872.XSHG HS300

# 第二步:选择主题,设置股票池

universe = ['601872.XSHG', ]

##训练模型

def model_train(begin_date,end_date):

data1=DataAPI.MktEqudGet(secID=u"601872.XSHG",beginDate=begin_date,endDate=end_date,field=['tradeDate','highestPrice','lowestPrice','openPrice','closePrice','turnoverVol','turnoverRate'],pandas="1")

data2=DataAPI.MktStockFactorsDateRangeGet(secID=u"601872.XSHG",beginDate=begin_date,endDate=end_date,field=['tradeDate','DAVOL5','EMA5','EMA10','MA5','MA20','RSI','VOL5','VOL10','MACD'],pandas="1")

df_data=pd.merge(data1,data2,on='tradeDate')

tmp=[]

for i in range(len(df_data.values)):

mark_1=0

for j in range(len(df_data.values[i])):

if str(df_data.values[i][j])=='nan':

mark_1=1

if mark_1==0:

a=list(df_data.values[i])

a.append(df_data.values[i][4]-df_data.values[i][10])

a.append(df_data.values[i][4]-df_data.values[i][11])

tmp.append(a)

data=tmp

print len(data)

x=[]

y=[]

for i in range(len(data)-1):

if data[i][4]<data[i+1][4]:

y.append(1)

else:

y.append(0)

x.append(data[i][1:])

x_train, x_test, y_train, y_test = train_test_split(x, y, test_size=0.0, random_state=42)

##训练模型

from sklearn import tree

clf = tree.DecisionTreeClassifier( max_depth =3 )

clf.fit(x_train,y_train)

y_predict=clf.predict(x_train)

n_1=0

for i in range(len(y_predict)):

if y_train[i]==y_predict[i]:

n_1=n_1+1

n_2=0

for i in range(len(y_predict)):

if y_train[i]==y_predict[i] and y_predict[i]==1:

n_2=n_2+1

joblib.dump(clf, 'clf.model')

return clf,float(n_1)/float( len(y_predict) ),float(n_2)/float( int(sum(y_train)) ) ,float(sum(y_train))/float(len(y_train))

def initialize(account):

##使用2015年2月1日之前800个交易日的数据进行训练

today='20150201'

train_begin_date = cal.advanceDate(today,'-800B',BizDayConvention.Preceding).strftime('%Y%m%d')

train_end_date = cal.advanceDate(today,'-1B',BizDayConvention.Preceding).strftime('%Y%m%d')

model,acc_rate,recall_rate,balance=model_train(train_begin_date,train_end_date)

print acc_rate,recall_rate,balance ##正确率、召回率、正负样本均衡度

def handle_data(account):

# 本策略将使用account的以下属性:

# account.referencePortfolioValue表示根据前收计算的当前持有证券市场价值与现金之和。

# account.universe表示当天,股票池中可以进行交易的证券池,剔除停牌退市等股票。

# account.referencePrice表示股票的参考价,一般使用的是上一日收盘价。

# account.valid_secpos字典,键为证券代码,值为虚拟账户中当前所持有该股票的数量。

c = account.referencePortfolioValue

today = account.current_date.strftime('%Y-%m-%d')

begin_date = cal.advanceDate(today,'-1B',BizDayConvention.Preceding).strftime('%Y%m%d')

end_date = cal.advanceDate(today,'-1B',BizDayConvention.Preceding).strftime('%Y%m%d')

data1=DataAPI.MktEqudGet(secID=u"601872.XSHG",beginDate=begin_date,endDate=end_date,field=['tradeDate','highestPrice','lowestPrice','openPrice','closePrice','turnoverVol','turnoverRate'],pandas="1")

data2=DataAPI.MktStockFactorsDateRangeGet(secID=u"601872.XSHG",beginDate=begin_date,endDate=end_date,field=['tradeDate','DAVOL5','EMA5','EMA10','MA5','MA20','RSI','VOL5','VOL10','MACD'],pandas="1")

df_data=pd.merge(data1,data2,on='tradeDate')

a=list(df_data.values[0])

a.append(df_data.values[0][4]-df_data.values[0][10])

a.append(df_data.values[0][4]-df_data.values[0][11])

x_predict=a[1:]

for i in range(len(x_predict)):

if str(x_predict[i])=='nan':

x_predict[i]=10000000

clf = joblib.load('clf.model')

y_predict=clf.predict(x_predict)

# 计算调仓数量

change = {}

for stock in account.universe:

if y_predict>0 and stock not in account.valid_secpos:

p = account.referencePrice[stock]

order(stock,int(c / p))

if y_predict==0 and stock in account.valid_secpos:

order_to(stock,0)

#print today,x_predict[3],y_predict

713

0.580056179775 0.334384858044 0.445224719101

This is an empty markdown cell