5.11 Fisher Transform · Using Fisher Transform Indicator

来源:https://uqer.io/community/share/54b5c288f9f06c276f651a16

策略思路:

在技术分析中,很多时候,人们都把股价数据当作正态分布的数据来分析。但是,其实股价数据分布并不符合正态分布。Fisher Transformation是一个可以把股价数据变为类似于正态分布的方法。

Fisher Transformation将市场数据的走势平滑化,去掉了一些尖锐的短期振荡;利用今日和前一日该指标的交错可以给出交易信号;

例如,对于沪深300指数使用Fisher变换的结果见本文后面的具体讨论。

Fisher Transformation

-

定义今日中间价:

mid=(low+high)/2 -

确定计算周期,例如可使用10日为周期。计算周期内最高价和最低价:

lowestLow=周期内最低价, highestHigh=周期内最高价 -

定义价变参数(其中的

ratio为0-1之间常数,例如可取0.5或0.33):

-

对价变参数

x使用Fisher变换,得到Fisher指标:

import quartz

import quartz.backtest as qb

import quartz.performance as qp

from quartz.api import *

import pandas as pd

import numpy as np

from datetime import datetime

from matplotlib import pylab

start = datetime(2014, 1, 1) # 回测起始时间

end = datetime(2014, 12, 10) # 回测结束时间

benchmark = 'HS300' # 使用沪深 300 作为参考标准

universe = set_universe('SH50') # 股票池

capital_base = 100000 # 起始资金

refresh_rate = 1

window = 10

# 本策略对于window非常非常敏感!!!

histFish = pd.DataFrame(0.0, index = universe, columns = ['preDiff', 'preFish', 'preState'])

def initialize(account): # 初始化虚拟账户状态

account.amount = 10000

account.universe = universe

add_history('hist', window)

def handle_data(account): # 每个交易日的买入卖出指令

for stk in account.universe:

prices = account.hist[stk]

if prices is None:

return

preDiff = histFish.at[stk, 'preDiff']

preFish = histFish.at[stk, 'preFish']

preState = histFish.at[stk, 'preState']

diff, fish = FisherTransIndicator(prices, preDiff, preFish)

if fish > preFish:

state = 1

elif fish < preFish:

state = -1

else:

state = 0

if state == 1 and preState == -1:

#stkAmount = int(account.amount / prices.iloc[-1]['openPrice'])

order(stk, account.amount)

elif state == -1 and preState == 1:

order_to(stk, 0)

histFish.at[stk, 'preDiff'] = diff

histFish.at[stk, 'preFish'] = fish

histFish.at[stk, 'preState'] = state

def FisherTransIndicator(windowData, preDiff, preFish):

# This function calculate the Fisher Transform indicator based on the data

# in the windowData.

minLowPrice = min(windowData['lowPrice'])

maxHghPrice = max(windowData['highPrice'])

tdyMidPrice = (windowData.iloc[-1]['lowPrice'] + windowData.iloc[-1]['highPrice'])/2.0

diffRatio = 0.33

# 本策略对于diffRatio同样非常敏感!!!

diff = (tdyMidPrice - minLowPrice)/(maxHghPrice - minLowPrice) - 0.5

diff = 2 * diff

diff = diffRatio * diff + (1.0 - diffRatio) * preDiff

if diff > 0.99:

diff = 0.999

elif diff < -0.99:

diff = -0.999

fish = np.log((1.0 + diff)/(1.0 - diff))

fish = 0.5 * fish + 0.5 * fish

return diff, fish

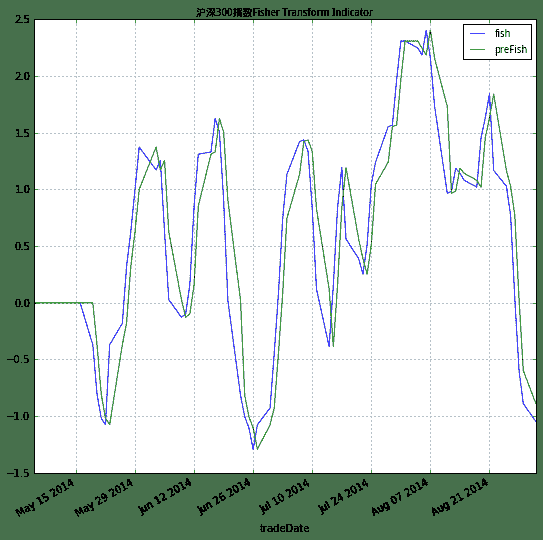

沪深300指数上使用Fisher Transformation

- 对最近半年的沪深300进行Fisher变换,得到的指标能够比较温和准确反映出指数的变化

from CAL.PyCAL import *

# DataAPI.MktIdxdGet返回pandas.DataFrame格式

index = DataAPI.MktIdxdGet(indexID = "000001.ZICN", beginDate = "20140501", endDate = "20140901")

index.head()

| indexID | tradeDate | ticker | secShortName | exchangeCD | preCloseIndex | openIndex | lowestIndex | highestIndex | closeIndex | turnoverVol | turnoverValue | CHG | CHGPct | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 000001.ZICN | 2014-05-05 | 1 | 上证综指 | XSHG | 2026.358 | 2022.178 | 2007.351 | 2028.957 | 2027.353 | 7993339500 | 60093487736 | 0.995 | 0.00049 |

| 1 | 000001.ZICN | 2014-05-06 | 1 | 上证综指 | XSHG | 2027.353 | 2024.256 | 2021.485 | 2038.705 | 2028.038 | 7460941100 | 57548110850 | 0.685 | 0.00034 |

| 2 | 000001.ZICN | 2014-05-07 | 1 | 上证综指 | XSHG | 2028.038 | 2023.152 | 2008.451 | 2024.631 | 2010.083 | 7436019200 | 57558051925 | -17.955 | -0.00885 |

| 3 | 000001.ZICN | 2014-05-08 | 1 | 上证综指 | XSHG | 2010.083 | 2006.853 | 2005.685 | 2036.941 | 2015.274 | 7786539300 | 59529365546 | 5.191 | 0.00258 |

| 4 | 000001.ZICN | 2014-05-09 | 1 | 上证综指 | XSHG | 2015.274 | 2016.501 | 2001.300 | 2020.454 | 2011.135 | 7622424400 | 57505383717 | -4.139 | -0.00205 |

def FisherTransIndicator(windowData, preDiff, preFish, state):

# This function calculate the Fisher Transform indicator based on the data

# in the windowData.

minLowPrice = min(windowData['lowestIndex'])

maxHghPrice = max(windowData['highestIndex'])

tdyMidPrice = (windowData.iloc[-1]['lowestIndex'] + windowData.iloc[-1]['highestIndex'])/2.0

diffRatio = 0.5

diff = (tdyMidPrice - minLowPrice)/(maxHghPrice - minLowPrice) - 0.5

diff = 2 * diff

if state == 1:

diff = diffRatio * diff + (1 - diffRatio) * preDiff

if diff > 0.995:

diff = 0.999

elif diff < -0.995:

diff = -0.999

fish = np.log((1 + diff)/(1 - diff))

if state == 1:

fish = 0.5 * fish + 0.5 * fish

return diff, fish

window = 10

index['diff'] = 0.0

index['fish'] = 0.0

index['preFish'] = 0.0

for i in range(window, index.shape[0]):

windowData = index.iloc[i-window : i]

if i == window:

diff, fish = FisherTransIndicator(windowData, 0, 0, 1)

index.at[i,'preFish'] = 0

index.at[i,'diff'] = diff

index.at[i,'fish'] = fish

else:

preDiff = index.iloc[i-1]['diff']

preFish = index.iloc[i-1]['fish']

diff, fish = FisherTransIndicator(windowData, preDiff, preFish, 1)

index.at[i,'preFish'] = preFish

index.at[i,'diff'] = diff

index.at[i,'fish'] = fish

Plot(index, settings = {'x':'tradeDate','y':'closeIndex', 'title':u'沪深300指数历史收盘价'})

Plot(index, settings = {'x':'tradeDate','y':['fish', 'preFish'], 'title':u'沪深300指数Fisher Transform Indicator'})

- 上图中的蓝色曲线表示Fisher指标,绿色曲线表示前一日的Fisher指标,两个指标的交错可以给出沪深300指数涨跌情况的信号