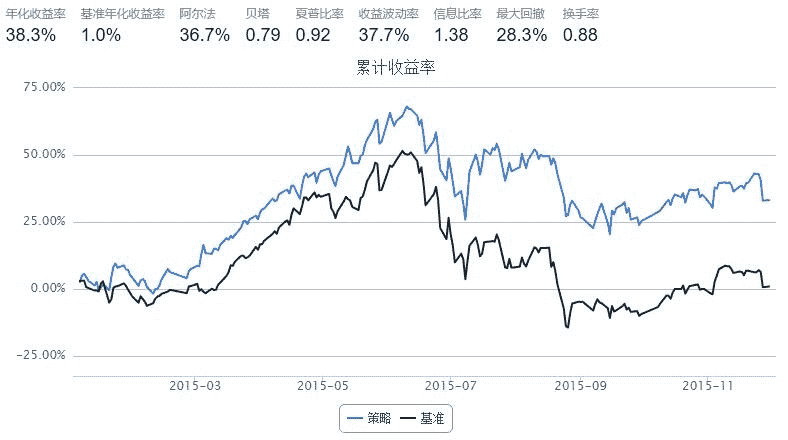

Porfolio(现金比率+负债现金+现金保障倍数)+市盈率

来源:https://uqer.io/community/share/566a896bf9f06c6c8a91cae7

?DataAPI.MktStockFactorsOneDayGet

import numpy as np

import pandas as pd

start = '2015-01-01' # 回测起始时间

end = '2015-11-30' # 回测结束时间

benchmark = 'HS300' # 策略参考标准

universe = set_universe('HS300') # 证券池,支持股票和基金

capital_base = 100000

# 起始资金

freq = 'd' # 策略类型,'d'表示日间策略使用日线回测,'m'表示日内策略使用分钟线回测

refresh_rate = 1 # 调仓频率,表示执行handle_data的时间间隔,若freq = 'd'时间间隔的单位为交易日,若freq = 'm'时间间隔为分钟

def initialize(account): # 初始化虚拟账户状态

pass

def handle_data(account): # 每个交易日的买入卖出指令

market_val = DataAPI.MktEqudGet(tradeDate=account.current_date,field=u"secID,negMarketValue",pandas="1") #获取所有股票的市值

factor = DataAPI.MktStockFactorsOneDayGet(tradeDate=account.current_date,field='secID,ROE,ROA,CashRateOfSales,FinancialExpenseRate,CashToCurrentLiability,OperCashInToCurrentLiability,GrossIncomeRatio,NetProfitRatio,PE,PB',pandas="1") #获取所有股票的相关因子

# print factor

factor.set_index('secID',inplace=True);

sec_val_mkt = {'symbol':[], 'factor_value':[], 'market_value':[]}

x='CashToCurrentLiability'

y='OperCashInToCurrentLiability'

z='PE'

for stock in account.universe:

sec_val_mkt['symbol'].append(stock)

factor_va=float(1/3*factor.ix[stock][x]+1/3*factor.ix[stock][y]+1/3*factor.ix[stock][z]);

sec_val_mkt['factor_value'].append(factor_va)

sec_val_mkt['market_value'].append(float(market_val.negMarketValue[market_val.secID==stock]))

sec_val_mkt = pd.DataFrame(sec_val_mkt).sort(columns='factor_value',ascending=True).reset_index()

sec_val_mkt = sec_val_mkt[:int(len(sec_val_mkt)*0.1)] #排序并选择前10%

buylist = list(sec_val_mkt.symbol)

#买入股票列表

sum_market_val = sum(sec_val_mkt.market_value)

position = np.array(sec_val_mkt.market_value)/sum_market_val*account.cash

for stock in account.valid_secpos:

if stock not in buylist:

order_to(stock, 0)

for stock in buylist:

if stock not in account.valid_secpos:

order(stock, position[buylist.index(stock)])

return

bt.blotter

None