user-defined package

Const Variable

获取数据,清洗数据

```py

def data_for_acb(ticker="000001", tstart=2010, tend=2015):

"""获取,清洗 ACB 模型所需要的数据。

ACB 模型需要数据:

负债合计[TLiab]

资产总计[TAssets]

未分配利润[retainedEarnings]

净利润[NIncome]

营运资本 = 资产总计 - 负债合计

"""

bs_data = DataAPI.FdmtBSGet(ticker=ticker, beginYear=tstart-1, endYear=tend,

field=['secID', 'endDate', 'publishDate', 'TLiab', 'TAssets', 'retainedEarnings'])

is_data = DataAPI.FdmtISGet(ticker=ticker, beginYear=tstart-1, endYear=tend,

field=['secID', 'endDate', 'publishDate', 'NIncome'])

bs_data = bs_data.drop_duplicates('endDate')

is_data = is_data.drop_duplicates('endDate')

data = is_data.merge(bs_data, on=['secID', 'endDate'])

# calculate TAssets diff of current and last report

pre_TAssets = []

length = len(data)

for index, number in enumerate(data.TAssets):

if index + 1 == length:

last_number = index

else:

last_number = index + 1

pre_TAssets.append(data.TAssets[last_number])

data['TAssetsPre'] = pre_TAssets

return data

def data_for_acbel(ticker="000001", tstart=2010, tend=2015):

"""获取,清洗 ACB 模型所需要的数据。

ACB 模型需要数据:

负债合计[TLiab]

资产总计[TAssets]

未分配利润[retainedEarnings]

净利润[NIncome]

营业总收入[tRevenue]

总市值[marketValue]

"""

bs_data = DataAPI.FdmtBSGet(ticker=ticker, beginYear=tstart-1, endYear=tend,

field=['secID', 'endDate', 'publishDate', 'TLiab', 'TAssets', 'retainedEarnings'])

is_data = DataAPI.FdmtISGet(ticker=ticker, beginYear=tstart-1, endYear=tend,

field=['secID', 'endDate', 'publishDate', 'NIncome', 'tRevenue'])

market_data = DataAPI.MktEqudGet(ticker=ticker, field=['secID', 'tradeDate', 'marketValue'])

market_data.rename(columns={'tradeDate': 'endDate'}, inplace=True)

bs_data = bs_data.drop_duplicates('endDate')

is_data = is_data.drop_duplicates('endDate')

data = is_data.merge(bs_data, on=['secID', 'endDate'])

endDate = list(data.endDate)

data = data.merge(market_data, on=['secID', 'endDate'], how='outer')

data.marketValue = data.marketValue.fillna(method='ffill')

data = data[data.endDate.isin(endDate)]

# calculate TAssets diff of current and last report

pre_TAssets = []

length = len(data)

for index, number in enumerate(data.TAssets):

if index + 1 == length:

last_number = index

else:

last_number = index + 1

pre_TAssets.append(data.TAssets[last_number])

data['TAssetsPre'] = pre_TAssets

return data

测试:获取数据,清洗数据

data_for_acb("002056").head(5)

| secID | endDate | publishDate_x | NIncome | publishDate_y | TLiab | TAssets | retainedEarnings | TAssetsPre | |

|---|---|---|---|---|---|---|---|---|---|

| 0 | 002056.XSHE | 2015-09-30 | 2015-10-28 | 2.657156e+08 | 2015-10-28 | 1.672345e+09 | 5.129504e+09 | 1.401169e+09 | 4.820643e+09 |

| 1 | 002056.XSHE | 2015-06-30 | 2015-08-27 | 1.482967e+08 | 2015-08-27 | 1.486623e+09 | 4.820643e+09 | 1.283617e+09 | 4.721675e+09 |

| 2 | 002056.XSHE | 2015-03-31 | 2015-04-27 | 6.872527e+07 | 2015-04-27 | 1.466576e+09 | 4.721675e+09 | 1.204153e+09 | 4.782852e+09 |

| 3 | 002056.XSHE | 2014-12-31 | 2015-03-28 | 3.814308e+08 | 2015-10-28 | 1.484829e+09 | 4.782852e+09 | 1.250498e+09 | 4.809435e+09 |

| 4 | 002056.XSHE | 2014-09-30 | 2015-10-28 | 9.175491e+07 | 2014-10-24 | 1.630937e+09 | 4.809435e+09 | 1.170975e+09 | 4.658186e+09 |

data_for_acbel("002056").head(5)

| secID | endDate | publishDate_x | NIncome | tRevenue | publishDate_y | TLiab | TAssets | retainedEarnings | marketValue | TAssetsPre | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 002056.XSHE | 2015-09-30 | 2015-10-28 | 2.657156e+08 | 2.882585e+09 | 2015-10-28 | 1.672345e+09 | 5.129504e+09 | 1.401169e+09 | 7790664000 | 4.820643e+09 |

| 1 | 002056.XSHE | 2015-06-30 | 2015-08-27 | 1.482967e+08 | 1.800482e+09 | 2015-08-27 | 1.486623e+09 | 4.820643e+09 | 1.283617e+09 | 12852952000 | 4.721675e+09 |

| 2 | 002056.XSHE | 2015-03-31 | 2015-04-27 | 6.872527e+07 | 8.511258e+08 | 2015-04-27 | 1.466576e+09 | 4.721675e+09 | 1.204153e+09 | 12064024000 | 4.782852e+09 |

| 3 | 002056.XSHE | 2014-12-31 | 2015-03-28 | 3.814308e+08 | 3.668800e+09 | 2015-10-28 | 1.484829e+09 | 4.782852e+09 | 1.250498e+09 | 9019255000 | 4.809435e+09 |

| 4 | 002056.XSHE | 2014-09-30 | 2015-10-28 | 9.175491e+07 | 9.342650e+08 | 2014-10-24 | 1.630937e+09 | 4.809435e+09 | 1.170975e+09 | 9187724000 | 4.658186e+09 |

计算 Z-score

def zscore_ACB(ticker=None, tstart=2010, tend=2015, coef=[0.517, -0.460, 18.640, 0.388, 1.158]):

# step 1. get data and pre-calculate the factor

ticker = data_for_acb(ticker, tstart, tend)

ticker['x0'] = 1

ticker['x1'] = ticker['TLiab'] / ticker['TAssets']

ticker['x2'] = ticker['NIncome'] * 2 / (ticker['TAssets'] + ticker['TAssetsPre'])

ticker['x3'] = (ticker['TAssets'] - ticker['TLiab']) / ticker['TAssets']

ticker['x4'] = ticker['retainedEarnings'] / ticker['TAssets']

# step 2. calculate zscore

tmp = ticker[['x0', 'x1', 'x2', 'x3', 'x4']] * coef

ticker['zscore'] = tmp.sum(axis=1)

# step 3. build result

ticker.sort('endDate', ascending=True, inplace=True)

return ticker[['secID', 'endDate', 'NIncome', 'TLiab', 'TAssets',

'retainedEarnings', 'x0', 'x1', 'x2', 'x3', 'x4', 'zscore']]

def zscore_ACBEL(ticker=None, tstart=2010, tend=2015, coef=[0.2086, 4.3465, 4.9601]):

# step 1. get data and pre-calculate the factor

ticker = data_for_acbel(ticker, tstart, tend)

ticker['x0'] = ticker['marketValue'] / ticker['TLiab']

ticker['x1'] = ticker['tRevenue'] / ticker['TAssets']

ticker['x2'] = (ticker['TAssets'] - ticker['TAssetsPre']) / ticker['TAssetsPre']

# step 2. calculate zscore

tmp = ticker[['x0', 'x1', 'x2']] * coef

ticker['zscore'] = tmp.sum(axis=1)

# step 3. build result

ticker.sort('endDate', ascending=True, inplace=True)

return ticker[['secID', 'endDate', 'NIncome', 'TLiab', 'tRevenue', 'TAssets',

'retainedEarnings', 'marketValue', 'TAssetsPre', 'x0', 'x1', 'x2', 'zscore']]

def get_ticker(bond=None):

"""Get the ticker number of a bond.

"""

# bondID -> partyID -> ticker

partyID = None

try:

data = DataAPI.BondGet(ticker=bond)

partyID = data['partyID'][0]

except:

return 'Cannot find this bond in DataAPI'

ticker = None

try:

data = DataAPI.SecIDGet(partyID=str(partyID))

ticker = data['ticker'][0]

except:

return 'Cannot find the ticker for this bond in DataAPI, maybe the issuer is not listed'

return ticker

测试:计算 Z-score

zscore_ACB("002506").head(5)

| secID | endDate | NIncome | TLiab | TAssets | retainedEarnings | x0 | x1 | x2 | x3 | x4 | zscore | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 21 | 002506.XSHE | 2009-12-31 | 1.699573e+08 | 7.039600e+08 | 1.262617e+09 | 2.845660e+08 | 1 | 0.557540 | 0.134607 | 0.442460 | 0.225378 | 3.202272 |

| 20 | 002506.XSHE | 2010-09-30 | 1.051847e+08 | 1.131338e+09 | 1.848964e+09 | 4.404125e+08 | 1 | 0.611877 | 0.067609 | 0.388123 | 0.238194 | 1.922180 |

| 19 | 002506.XSHE | 2010-12-31 | 2.194191e+08 | 1.398571e+09 | 4.466591e+09 | 4.881275e+08 | 1 | 0.313118 | 0.069485 | 0.686882 | 0.109284 | 2.061233 |

| 18 | 002506.XSHE | 2011-03-31 | 3.719796e+07 | 1.841932e+09 | 4.946957e+09 | 5.261166e+08 | 1 | 0.372336 | 0.007903 | 0.627664 | 0.106352 | 0.859727 |

| 17 | 002506.XSHE | 2011-06-30 | 1.313367e+08 | 2.631518e+09 | 5.728841e+09 | 5.177251e+08 | 1 | 0.459346 | 0.024605 | 0.540654 | 0.090372 | 1.078754 |

zscore_ACBEL("002506").head(5)

| secID | endDate | NIncome | TLiab | tRevenue | TAssets | retainedEarnings | marketValue | TAssetsPre | x0 | x1 | x2 | zscore | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 21 | 002506.XSHE | 2009-12-31 | 1.699573e+08 | 7.039600e+08 | 1.318242e+09 | 1.262617e+09 | 2.845660e+08 | 11732836000 | 1.262617e+09 | 16.666906 | 1.044055 | 0.000000 | 8.014703 |

| 20 | 002506.XSHE | 2010-09-30 | 1.545466e+08 | 1.131338e+09 | 1.646226e+09 | 1.848964e+09 | 4.404125e+08 | 11732836000 | 1.262617e+09 | 10.370759 | 0.890350 | 0.464390 | 8.336670 |

| 19 | 002506.XSHE | 2010-12-31 | 2.194191e+08 | 1.398571e+09 | 2.686649e+09 | 4.466591e+09 | 4.881275e+08 | 11732836000 | 1.848964e+09 | 8.389163 | 0.601499 | 1.415726 | 11.386537 |

| 18 | 002506.XSHE | 2011-03-31 | 3.719796e+07 | 1.841932e+09 | 6.502649e+08 | 4.946957e+09 | 5.261166e+08 | 12586900000 | 4.466591e+09 | 6.833531 | 0.131447 | 0.107547 | 2.530253 |

| 17 | 002506.XSHE | 2011-06-30 | 1.313367e+08 | 2.631518e+09 | 1.797884e+09 | 5.728841e+09 | 5.177251e+08 | 10174960000 | 4.946957e+09 | 3.866575 | 0.313830 | 0.158053 | 2.954592 |

a = zscore_ACBEL("002506")

a.head(3)

| secID | endDate | NIncome | TLiab | tRevenue | TAssets | retainedEarnings | marketValue | TAssetsPre | x0 | x1 | x2 | zscore | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 21 | 002506.XSHE | 2009-12-31 | 1.699573e+08 | 7.039600e+08 | 1.318242e+09 | 1.262617e+09 | 2.845660e+08 | 11732836000 | 1.262617e+09 | 16.666906 | 1.044055 | 0.000000 | 8.014703 |

| 20 | 002506.XSHE | 2010-09-30 | 1.051847e+08 | 1.131338e+09 | 6.184189e+08 | 1.848964e+09 | 4.404125e+08 | 11732836000 | 1.262617e+09 | 10.370759 | 0.334468 | 0.464390 | 5.920527 |

| 19 | 002506.XSHE | 2010-12-31 | 2.194191e+08 | 1.398571e+09 | 2.686649e+09 | 4.466591e+09 | 4.881275e+08 | 11732836000 | 1.848964e+09 | 8.389163 | 0.601499 | 1.415726 | 11.386537 |

作图分析

def zscore_plot(dataframe, upper_limit, low_limit):

ax = dataframe.plot('endDate', ['zscore'], figsize=(20, 10), style='g-', title='zscore curve',)

axhspan(low_limit, dataframe.zscore.min(), facecolor='maroon', alpha=0.1)

axhspan(upper_limit, dataframe.zscore.max(), facecolor='yellow', alpha=0.2)

ax.legend()

return ax

测试:作图分析

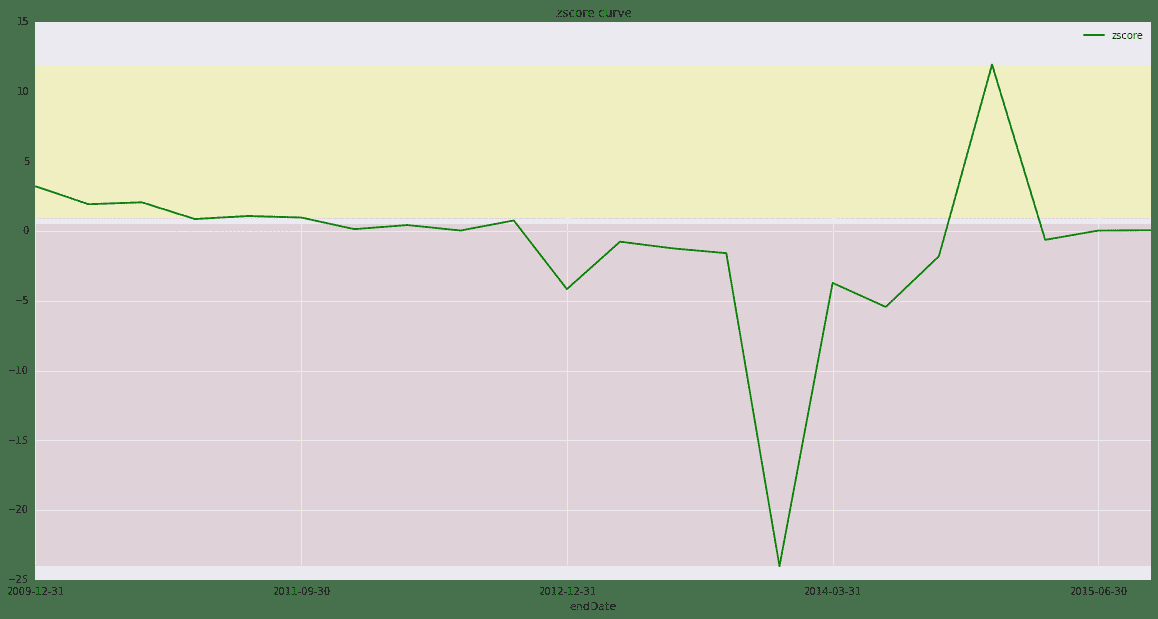

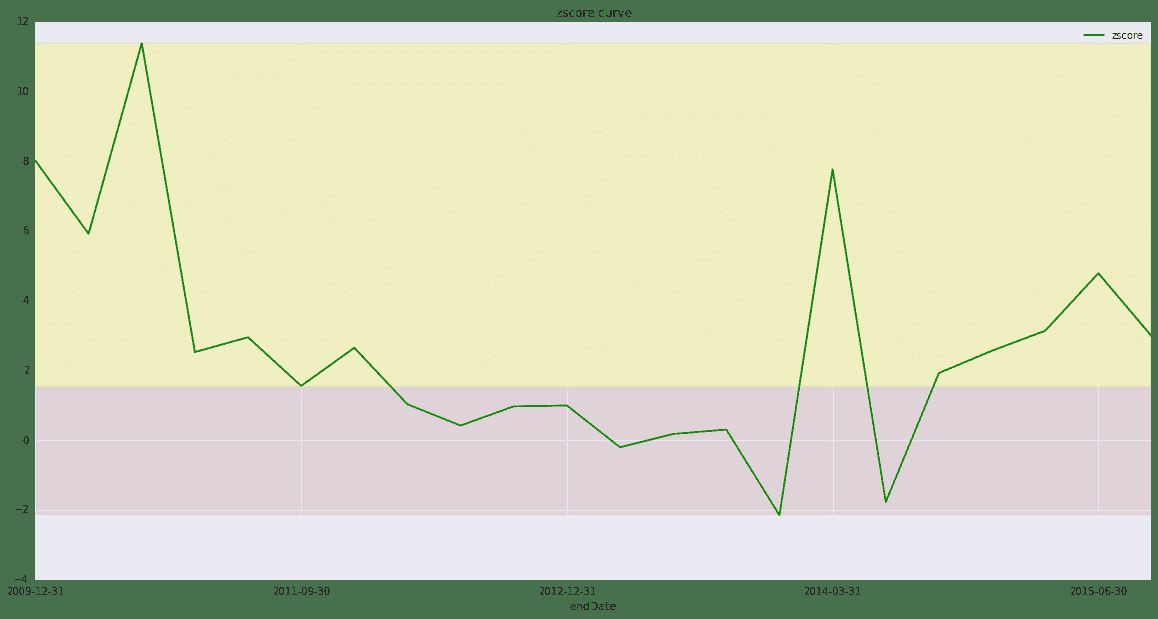

这里,我们以 11超日债[112061] 来做测试,看看当前这个模型表现怎么样。

- step 1: 调用

get_ticker函数通过债券代码获取发行人上市代码,在发行人已上市的前提下; - step 2: 调用

zscore_ACBEL或zscore_ACB计算发行人的 Z-score 值; - step 3: 调用

zscore_plot绘制 Z-score 曲线;

ticker = get_ticker("112061")

df = zscore_ACBEL(ticker)

zscore_plot(df, 1.5408, 1.5408)

<matplotlib.axes.AxesSubplot at 0x5220a10>

ticker = get_ticker("112061")

df = zscore_ACB(ticker)

zscore_plot(df, 0.9, 0.5)

<matplotlib.axes.AxesSubplot at 0x525c610>