【50ETF期权】 期权择时指数 1.0

来源:https://uqer.io/community/share/561c883df9f06c4ca72fb5f7

本文中,我们使用期权的日行情数据,计算期权情绪指标,并用以指导实战择时

初步讨论只包括两个指标

- 成交量(成交额) PCR:看跌看涨期权的成交量(成交额)比率

- PCIVD:Put Call Implied Volatility Difference 看跌看涨期权隐含波动率差

from CAL.PyCAL import *

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

from matplotlib import rc

rc('mathtext', default='regular')

import seaborn as sns

sns.set_style('white')

from matplotlib import dates

from pandas import concat

from scipy import interpolate

import math

1. 看跌看涨成交量(成交额)比率 PCR

- 计算每日看跌看涨成交量或成交额的比率,即PCR

- 我们考虑PCR每日变化量与现货50ETF隔日收益率的关系

- 每日PCR变化量PCRD为:当日PCR减去前一日PCR得到的值,即对PCR做差分

def histVolumeOpt50ETF(beginDate, endDate):

## 计算历史一段时间内的50ETF期权持仓量交易量数据

optionVarSecID = u"510050.XSHG"

cal = Calendar('China.SSE')

dates = cal.bizDatesList(beginDate, endDate)

dates = map(Date.toDateTime, dates)

columns = ['callVol', 'putVol', 'callValue',

'putValue', 'callOpenInt', 'putOpenInt',

'nearCallVol', 'nearPutVol', 'nearCallValue',

'nearPutValue', 'nearCallOpenInt', 'nearPutOpenInt',

'netVol', 'netValue', 'netOpenInt',

'volPCR', 'valuePCR', 'openIntPCR',

'nearVolPCR', 'nearValuePCR', 'nearOpenIntPCR']

hist_opt = pd.DataFrame(0.0, index=dates, columns=columns)

hist_opt.index.name = 'date'

# 每一个交易日数据单独计算

for date in hist_opt.index:

date_str = Date.fromDateTime(date).toISO().replace('-', '')

try:

opt_data = DataAPI.MktOptdGet(secID=u"", tradeDate=date_str, field=u"", pandas="1")

except:

hist_opt = hist_opt.drop(date)

continue

opt_type = []

exp_date = []

for ticker in opt_data.secID.values:

opt_type.append(ticker[6])

exp_date.append(ticker[7:11])

opt_data['optType'] = opt_type

opt_data['expDate'] = exp_date

near_exp = np.sort(opt_data.expDate.unique())[0]

data = opt_data.groupby('optType')

# 计算所有上市期权:看涨看跌交易量、看涨看跌交易额、看涨看跌持仓量

hist_opt['callVol'][date] = data.turnoverVol.sum()['C']

hist_opt['putVol'][date] = data.turnoverVol.sum()['P']

hist_opt['callValue'][date] = data.turnoverValue.sum()['C']

hist_opt['putValue'][date] = data.turnoverValue.sum()['P']

hist_opt['callOpenInt'][date] = data.openInt.sum()['C']

hist_opt['putOpenInt'][date] = data.openInt.sum()['P']

near_data = opt_data[opt_data.expDate == near_exp]

near_data = near_data.groupby('optType')

# 计算近月期权(主力合约): 看涨看跌交易量、看涨看跌交易额、看涨看跌持仓量

hist_opt['nearCallVol'][date] = near_data.turnoverVol.sum()['C']

hist_opt['nearPutVol'][date] = near_data.turnoverVol.sum()['P']

hist_opt['nearCallValue'][date] = near_data.turnoverValue.sum()['C']

hist_opt['nearPutValue'][date] = near_data.turnoverValue.sum()['P']

hist_opt['nearCallOpenInt'][date] = near_data.openInt.sum()['C']

hist_opt['nearPutOpenInt'][date] = near_data.openInt.sum()['P']

# 计算所有上市期权: 总交易量、总交易额、总持仓量

hist_opt['netVol'][date] = hist_opt['callVol'][date] + hist_opt['putVol'][date]

hist_opt['netValue'][date] = hist_opt['callValue'][date] + hist_opt['putValue'][date]

hist_opt['netOpenInt'][date] = hist_opt['callOpenInt'][date] + hist_opt['putOpenInt'][date]

# 计算期权看跌看涨期权交易量(持仓量)的比率:

# 交易量看跌看涨比率,交易额看跌看涨比率, 持仓量看跌看涨比率

# 近月期权交易量看跌看涨比率,近月期权交易额看跌看涨比率, 近月期权持仓量看跌看涨比率

# PCR = Put Call Ratio

hist_opt['volPCR'][date] = round(hist_opt['putVol'][date]*1.0/hist_opt['callVol'][date], 4)

hist_opt['valuePCR'][date] = round(hist_opt['putValue'][date]*1.0/hist_opt['callValue'][date], 4)

hist_opt['openIntPCR'][date] = round(hist_opt['putOpenInt'][date]*1.0/hist_opt['callOpenInt'][date], 4)

hist_opt['nearVolPCR'][date] = round(hist_opt['nearPutVol'][date]*1.0/hist_opt['nearCallVol'][date], 4)

hist_opt['nearValuePCR'][date] = round(hist_opt['nearPutValue'][date]*1.0/hist_opt['nearCallValue'][date], 4)

hist_opt['nearOpenIntPCR'][date] = round(hist_opt['nearPutOpenInt'][date]*1.0/hist_opt['nearCallOpenInt'][date], 4)

return hist_opt

def histPrice50ETF(beginDate, endDate):

# 华夏上证50ETF收盘价数据

secID = '510050.XSHG'

begin = Date.fromDateTime(beginDate).toISO().replace('-', '')

end = Date.fromDateTime(endDate).toISO().replace('-', '')

fields = ['tradeDate', 'closePrice', 'preClosePrice']

etf = DataAPI.MktFunddGet(secID, beginDate=begin, endDate=end, field=fields)

etf['tradeDate'] = pd.to_datetime(etf['tradeDate'])

etf['dailyReturn'] = etf['closePrice'] / etf['preClosePrice'] - 1.0

etf = etf.set_index('tradeDate')

return etf

def histPCR50ETF(beginDate, endDate):

# PCRD: Put Call Ratio Diff

# 计算每日PCR变化量:当日PCR减去前一日PCR得到的值,即对PCR做差分

# 专注于某一项PCR,例如:成交额PCR --- valuePCR

pcr_names = ['volPCR', 'valuePCR', 'openIntPCR',

'nearVolPCR', 'nearValuePCR', 'nearOpenIntPCR']

pcr_diff_names = [pcr + 'Diff' for pcr in pcr_names]

pcr = histVolumeOpt50ETF(beginDate, endDate)

for pcr_name in pcr_names:

pcr[pcr_name + 'Diff'] = pcr[pcr_name].diff()

return pcr[pcr_names + pcr_diff_names]

计算PCR

- 期权自15年2月9号上市

- 此处计算得到的数据可以用在后面几条策略中

## PCRD计算示例

start = datetime(2015,2, 9) # 回测起始时间

end = datetime(2015, 10, 13) # 回测结束时间

hist_pcrd = histPCR50ETF(start, end) # 计算PCRD

hist_pcrd.tail()

| volPCR | valuePCR | openIntPCR | nearVolPCR | nearValuePCR | nearOpenIntPCR | volPCRDiff | valuePCRDiff | openIntPCRDiff | nearVolPCRDiff | nearValuePCRDiff | nearOpenIntPCRDiff | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| date | ||||||||||||

| 2015-09-29 | 1.0863 | 1.5860 | 0.6680 | 1.2372 | 1.6552 | 0.7632 | 0.0255 | 0.4779 | -0.0058 | 0.0801 | 0.6352 | -0.0193 |

| 2015-09-30 | 0.9664 | 1.1366 | 0.6709 | 1.1153 | 1.1460 | 0.7579 | -0.1199 | -0.4494 | 0.0029 | -0.1219 | -0.5092 | -0.0053 |

| 2015-10-08 | 0.8997 | 0.5940 | 0.6726 | 0.9244 | 0.4646 | 0.7480 | -0.0667 | -0.5426 | 0.0017 | -0.1909 | -0.6814 | -0.0099 |

| 2015-10-09 | 1.0979 | 0.7708 | 0.7068 | 1.1542 | 0.6672 | 0.8121 | 0.1982 | 0.1768 | 0.0342 | 0.2298 | 0.2026 | 0.0641 |

| 2015-10-12 | 0.6494 | 0.2432 | 0.7713 | 0.6604 | 0.2002 | 1.0197 | -0.4485 | -0.5276 | 0.0645 | -0.4938 | -0.4670 | 0.2076 |

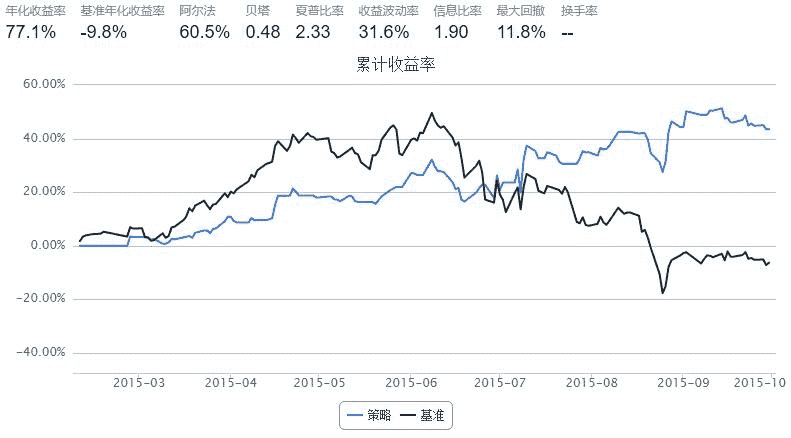

1.1 使用基于成交量 PCR 日变化量的择时策略

策略思路:考虑成交量 PCR 日变化量 PCRD(volume)

- 前一日PCRD(volume)小于0,则今天全仓50ETF

- 否则,清仓观望

- 简单来说,就是PCR上升,空仓;PCR下降,买入

start = datetime(2015, 2, 9) # 回测起始时间

end = datetime(2015, 10, 7) # 回测结束时间

benchmark = '510050.XSHG' # 策略参考标准

universe = ['510050.XSHG'] # 股票池

capital_base = 100000 # 起始资金

commission = Commission(0.0,0.0)

refresh_rate = 1

# hist_pcrd = histPCR50ETF(start, end) # 计算PCRD

def initialize(account): # 初始化虚拟账户状态

account.fund = universe[0]

def handle_data(account): # 每个交易日的买入卖出指令

fund = account.fund

# 获取回测当日的前一天日期

dt = Date.fromDateTime(account.current_date)

cal = Calendar('China.IB')

last_day = cal.advanceDate(dt,'-1B',BizDayConvention.Preceding) #计算出倒数第一个交易日

last_day_str = last_day.strftime("%Y-%m-%d")

# 计算买入卖出信号

try:

# 拿取PCRD数据

pcrd_last_vol = hist_pcrd.volPCRDiff.loc[last_day_str] # PCRD(volumn)

long_flag = True if pcrd_last_vol < 0 else False # 调仓条件

except:

long_flag = False

if long_flag:

# 买入时,全仓杀入

try:

approximationAmount = int(account.cash / account.referencePrice[fund] / 100.0) * 100

order(fund, approximationAmount)

except:

return

else:

# 卖出时,全仓清空

order_to(fund, 0)

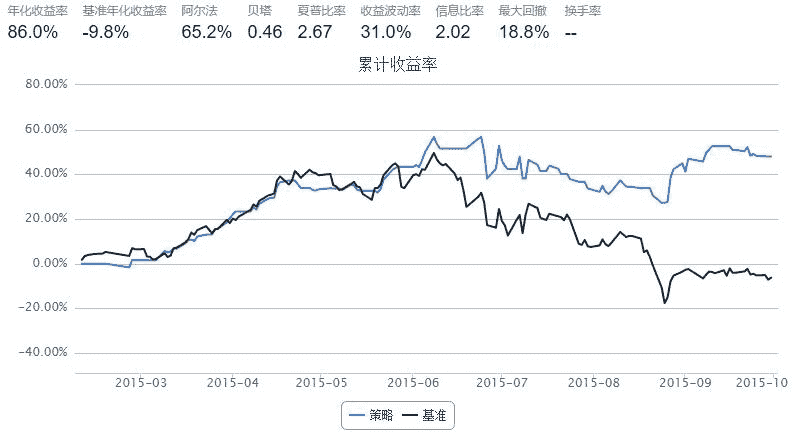

1.2 使用基于成交额 PCR 日变化量的择时策略

策略思路:考虑成交额 PCR 日变化量 PCRD(value)

- 前一日PCRD(value)小于0,则今天全仓50ETF

- 否则,清仓观望

- 简单来说,就是PCR上升,空仓;PCR下降,买入

start = datetime(2015, 2, 9) # 回测起始时间

end = datetime(2015, 10, 7) # 回测结束时间

benchmark = '510050.XSHG' # 策略参考标准

universe = ['510050.XSHG'] # 股票池

capital_base = 100000 # 起始资金

commission = Commission(0.0,0.0)

refresh_rate = 1

# hist_pcrd = histPCR50ETF(start, end) # 计算PCRD

def initialize(account): # 初始化虚拟账户状态

account.fund = universe[0]

def handle_data(account): # 每个交易日的买入卖出指令

fund = account.fund

# 获取回测当日的前一天日期

dt = Date.fromDateTime(account.current_date)

cal = Calendar('China.IB')

last_day = cal.advanceDate(dt,'-1B',BizDayConvention.Preceding) #计算出倒数第一个交易日

last_day_str = last_day.strftime("%Y-%m-%d")

# 计算买入卖出信号

try:

# 拿取PCRD数据

pcrd_last_value = hist_pcrd.valuePCRDiff.loc[last_day_str] # PCRD(value)

long_flag = True if pcrd_last_value < 0 else False # 调仓条件

except:

long_flag = False

if long_flag:

# 买入时,全仓杀入

try:

approximationAmount = int(account.cash / account.referencePrice[fund] / 100.0) * 100

order(fund, approximationAmount)

except:

return

else:

# 卖出时,全仓清空

order_to(fund, 0)

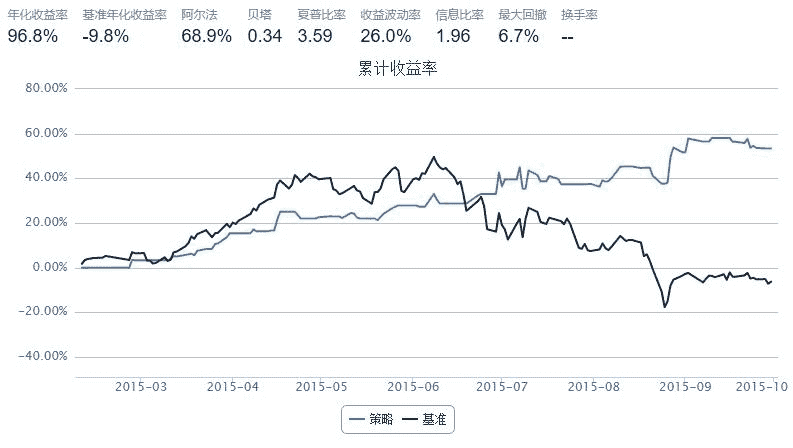

1.3 结合使用成交量、成交额 PCR 日变化量的择时策略

策略思路:考虑成交量PCRD(volume) 和成交额PCRD(value)

- 前一日PCRD(volume)和PCRD(value)同时小于0,则今天全仓50ETF

- 否则,清仓观望

start = datetime(2015, 2, 9) # 回测起始时间

end = datetime(2015, 10, 7) # 回测结束时间

benchmark = '510050.XSHG' # 策略参考标准

universe = ['510050.XSHG'] # 股票池

capital_base = 100000 # 起始资金

commission = Commission(0.0,0.0)

refresh_rate = 1

hist_pcrd = histPCR50ETF(start, end) # 计算PCRD

def initialize(account): # 初始化虚拟账户状态

account.fund = universe[0]

def handle_data(account): # 每个交易日的买入卖出指令

fund = account.fund

# 获取回测当日的前一天日期

dt = Date.fromDateTime(account.current_date)

cal = Calendar('China.IB')

last_day = cal.advanceDate(dt,'-1B',BizDayConvention.Preceding) #计算出倒数第一个交易日

last_day_str = last_day.strftime("%Y-%m-%d")

# 计算买入卖出信号

try:

# 拿取PCRD数据

pcrd_last_value = hist_pcrd.valuePCRDiff.loc[last_day_str] # PCRD(value)

pcrd_last_vol = hist_pcrd.volPCRDiff.loc[last_day_str] # PCRD(volumn)

long_flag = True if pcrd_last_value < 0.0 and pcrd_last_vol < 0.0 else False # 调仓条件

except:

long_flag = False

if long_flag:

# 买入时,全仓杀入

try:

approximationAmount = int(account.cash / account.referencePrice[fund] / 100.0) * 100

order(fund, approximationAmount)

except:

return

else:

# 卖出时,全仓清空

order_to(fund, 0)

2. 看跌看涨隐含波动率价差 PCIVD

- 相同到期日、行权价的看跌看涨期权,其隐含波动率会有差异

- 由于套保需要,一般看跌期权隐含波动率高于看涨期权

- 看跌、看涨期权隐含波动率之差 PCIVD 的每日变化可以用来指导实际操作

- 在计算中,我们使用平值附近的期权计算 PCIVD

## 银行间质押式回购利率

def histDayInterestRateInterbankRepo(date):

cal = Calendar('China.SSE')

period = Period('-10B')

begin = cal.advanceDate(date, period)

begin_str = begin.toISO().replace('-', '')

date_str = date.toISO().replace('-', '')

# 以下的indicID分别对应的银行间质押式回购利率周期为:

# 1D, 7D, 14D, 21D, 1M, 3M, 4M, 6M, 9M, 1Y

indicID = [u"M120000067", u"M120000068", u"M120000069", u"M120000070", u"M120000071",

u"M120000072", u"M120000073", u"M120000074", u"M120000075", u"M120000076"]

period = np.asarray([1.0, 7.0, 14.0, 21.0, 30.0, 90.0, 120.0, 180.0, 270.0, 360.0]) / 360.0

period_matrix = pd.DataFrame(index=indicID, data=period, columns=['period'])

field = u"indicID,indicName,publishTime,periodDate,dataValue,unit"

interbank_repo = DataAPI.ChinaDataInterestRateInterbankRepoGet(indicID=indicID,beginDate=begin_str,endDate=date_str,field=field,pandas="1")

interbank_repo = interbank_repo.groupby('indicID').first()

interbank_repo = concat([interbank_repo, period_matrix], axis=1, join='inner').sort_index()

return interbank_repo

## 银行间同业拆借利率

def histDaySHIBOR(date):

cal = Calendar('China.SSE')

period = Period('-10B')

begin = cal.advanceDate(date, period)

begin_str = begin.toISO().replace('-', '')

date_str = date.toISO().replace('-', '')

# 以下的indicID分别对应的SHIBOR周期为:

# 1D, 7D, 14D, 1M, 3M, 6M, 9M, 1Y

indicID = [u"M120000057", u"M120000058", u"M120000059", u"M120000060",

u"M120000061", u"M120000062", u"M120000063", u"M120000064"]

period = np.asarray([1.0, 7.0, 14.0, 30.0, 90.0, 180.0, 270.0, 360.0]) / 360.0

period_matrix = pd.DataFrame(index=indicID, data=period, columns=['period'])

field = u"indicID,indicName,publishTime,periodDate,dataValue,unit"

interest_shibor = DataAPI.ChinaDataInterestRateSHIBORGet(indicID=indicID,beginDate=begin_str,endDate=date_str,field=field,pandas="1")

interest_shibor = interest_shibor.groupby('indicID').first()

interest_shibor = concat([interest_shibor, period_matrix], axis=1, join='inner').sort_index()

return interest_shibor

## 插值得到给定的周期的无风险利率

def periodsSplineRiskFreeInterestRate(date, periods):

# 此处使用SHIBOR来插值

init_shibor = histDaySHIBOR(date)

shibor = {}

min_period = min(init_shibor.period.values)

min_period = 25.0/360.0

max_period = max(init_shibor.period.values)

for p in periods.keys():

tmp = periods[p]

if periods[p] > max_period:

tmp = max_period * 0.99999

elif periods[p] < min_period:

tmp = min_period * 1.00001

sh = interpolate.spline(init_shibor.period.values, init_shibor.dataValue.values, [tmp], order=3)

shibor[p] = sh[0]/100.0

return shibor

## 使用DataAPI.OptGet, DataAPI.MktOptdGet拿到计算所需数据

def histDayDataOpt50ETF(date):

date_str = date.toISO().replace('-', '')

#使用DataAPI.OptGet,拿到已退市和上市的所有期权的基本信息

info_fields = [u'optID', u'varSecID', u'varShortName', u'varTicker', u'varExchangeCD', u'varType',

u'contractType', u'strikePrice', u'contMultNum', u'contractStatus', u'listDate',

u'expYear', u'expMonth', u'expDate', u'lastTradeDate', u'exerDate', u'deliDate',

u'delistDate']

opt_info = DataAPI.OptGet(optID='', contractStatus=[u"DE",u"L"], field=info_fields, pandas="1")

#使用DataAPI.MktOptdGet,拿到历史上某一天的期权成交信息

mkt_fields = [u'ticker', u'optID', u'secShortName', u'exchangeCD', u'tradeDate', u'preSettlePrice',

u'preClosePrice', u'openPrice', u'highestPrice', u'lowestPrice', u'closePrice',

u'settlPrice', u'turnoverVol', u'turnoverValue', u'openInt']

opt_mkt = DataAPI.MktOptdGet(tradeDate=date_str, field=mkt_fields, pandas = "1")

opt_info = opt_info.set_index(u"optID")

opt_mkt = opt_mkt.set_index(u"optID")

opt = concat([opt_info, opt_mkt], axis=1, join='inner').sort_index()

return opt

# 旧版forward计算稍有差别

def histDayMktForwardPriceOpt50ETF(opt, risk_free):

exp_dates_str = np.sort(opt.expDate.unique())

trade_date = Date.parseISO(opt.tradeDate.values[0])

forward = {}

for date_str in exp_dates_str:

opt_date = opt[opt.expDate == date_str]

opt_call_date = opt_date[opt_date.contractType == 'CO']

opt_put_date = opt_date[opt_date.contractType == 'PO']

opt_call_date = opt_call_date[[u'strikePrice', u'price']].set_index('strikePrice').sort_index()

opt_put_date = opt_put_date[[u'strikePrice', u'price']].set_index('strikePrice').sort_index()

opt_call_date.columns = [u'callPrice']

opt_put_date.columns = [u'putPrice']

opt_date = concat([opt_call_date, opt_put_date], axis=1, join='inner').sort_index()

opt_date['diffCallPut'] = opt_date.callPrice - opt_date.putPrice

strike = abs(opt_date['diffCallPut']).idxmin()

priceDiff = opt_date['diffCallPut'][strike]

date = Date.parseISO(date_str)

ttm = abs(float(date - trade_date + 1.0)/365.0)

rf = risk_free[date]

fw = strike + np.exp(ttm*rf) * priceDiff

forward[date] = fw

return forward

## 分析历史某一日的期权收盘价信息,得到隐含波动率微笑和期权风险指标

def histDayAnalysisOpt50ETF(date):

opt_var_sec = u"510050.XSHG" # 期权标的

opt = histDayDataOpt50ETF(date)

#使用DataAPI.MktFunddGet拿到期权标的的日行情

date_str = date.toISO().replace('-', '')

opt_var_mkt = DataAPI.MktFunddGet(secID=opt_var_sec,tradeDate=date_str,beginDate=u"",endDate=u"",field=u"",pandas="1")

#opt_var_mkt = DataAPI.MktFunddAdjGet(secID=opt_var_sec,beginDate=date_str,endDate=date_str,field=u"",pandas="1")

# 计算shibor

exp_dates_str = opt.expDate.unique()

periods = {}

for date_str in exp_dates_str:

exp_date = Date.parseISO(date_str)

periods[exp_date] = (exp_date - date)/360.0

shibor = periodsSplineRiskFreeInterestRate(date, periods)

# 计算forward price

opt_tmp = opt[[u'contractType', u'tradeDate', u'strikePrice', u'expDate', u'settlPrice']]

opt_tmp.columns = [[u'contractType', u'tradeDate', u'strikePrice', u'expDate', u'price']]

forward_price = histDayMktForwardPriceOpt50ETF(opt_tmp, shibor)

settle = opt.settlPrice.values # 期权 settle price

close = opt.closePrice.values # 期权 close price

strike = opt.strikePrice.values # 期权 strike price

option_type = opt.contractType.values # 期权类型

exp_date_str = opt.expDate.values # 期权行权日期

eval_date_str = opt.tradeDate.values # 期权交易日期

mat_dates = []

eval_dates = []

spot = []

for epd, evd in zip(exp_date_str, eval_date_str):

mat_dates.append(Date.parseISO(epd))

eval_dates.append(Date.parseISO(evd))

spot.append(opt_var_mkt.closePrice[0])

time_to_maturity = [float(mat - eva + 1.0)/365.0 for (mat, eva) in zip(mat_dates, eval_dates)]

risk_free = [] # 无风险利率

forward = [] # 市场远期

for s, mat, time in zip(spot, mat_dates, time_to_maturity):

#rf = math.log(forward_price[mat] / s) / time

rf = shibor[mat]

risk_free.append(rf)

forward.append(forward_price[mat])

opt_types = [] # 期权类型

for t in option_type:

if t == 'CO':

opt_types.append(1)

else:

opt_types.append(-1)

# 使用通联CAL包中 BSMImpliedVolatity 计算隐含波动率

calculated_vol = BSMImpliedVolatity(opt_types, strike, spot, risk_free, 0.0, time_to_maturity, settle)

calculated_vol = calculated_vol.fillna(0.0)

# 使用通联CAL包中 BSMPrice 计算期权风险指标

greeks = BSMPrice(opt_types, strike, spot, risk_free, 0.0, calculated_vol.vol.values, time_to_maturity)

# vega、rho、theta 的计量单位参照上交所的数据,以求统一对比

greeks.vega = greeks.vega #/ 100.0

greeks.rho = greeks.rho #/ 100.0

greeks.theta = greeks.theta #* 365.0 / 252.0 #/ 365.0

opt['strike'] = strike

opt['forward'] = np.around(forward, decimals=3)

opt['optType'] = option_type

opt['expDate'] = exp_date_str

opt['spotPrice'] = spot

opt['riskFree'] = risk_free

opt['timeToMaturity'] = np.around(time_to_maturity, decimals=4)

opt['settle'] = np.around(greeks.price.values.astype(np.double), decimals=4)

opt['iv'] = np.around(calculated_vol.vol.values.astype(np.double), decimals=4)

opt['delta'] = np.around(greeks.delta.values.astype(np.double), decimals=4)

opt['vega'] = np.around(greeks.vega.values.astype(np.double), decimals=4)

opt['gamma'] = np.around(greeks.gamma.values.astype(np.double), decimals=4)

opt['theta'] = np.around(greeks.theta.values.astype(np.double), decimals=4)

opt['rho'] = np.around(greeks.rho.values.astype(np.double), decimals=4)

fields = [u'ticker', u'contractType', u'strikePrice', 'forward', u'expDate', u'tradeDate',

u'closePrice', u'settlPrice', 'spotPrice', u'iv',

u'delta', u'vega', u'gamma', u'theta', u'rho']

opt = opt[fields].reset_index().set_index('ticker').sort_index()

#opt['iv'] = opt.iv.replace(to_replace=0.0, value=np.nan)

return opt

# 每日期权分析数据整理

def histDayGreeksIVOpt50ETF(date):

# Uqer 计算期权的风险数据

opt = histDayAnalysisOpt50ETF(date)

# 整理数据部分

opt.index = [index[-10:] for index in opt.index]

opt = opt[['contractType','strikePrice','spotPrice','forward','expDate','closePrice','iv','delta','theta','gamma','vega','rho']]

opt.columns = [['contractType','strike','spot','forward','expDate','close','iv','delta','theta','gamma','vega','rho']]

opt_call = opt[opt.contractType=='CO']

opt_put = opt[opt.contractType=='PO']

opt_call.columns = pd.MultiIndex.from_tuples([('Call', c) for c in opt_call.columns])

opt_call[('Call-Put', 'strike')] = opt_call[('Call', 'strike')]

opt_call[('Call-Put', 'spot')] = opt_call[('Call', 'spot')]

opt_call[('Call-Put', 'forward')] = opt_call[('Call', 'forward')]

opt_put.columns = pd.MultiIndex.from_tuples([('Put', c) for c in opt_put.columns])

opt = concat([opt_call, opt_put], axis=1, join='inner').sort_index()

opt = opt.set_index(('Call','expDate')).sort_index()

opt = opt.drop([('Call','contractType'), ('Call','strike'), ('Call','forward'), ('Call','spot')], axis=1)

opt = opt.drop([('Put','expDate'), ('Put','contractType'), ('Put','strike'), ('Put','forward'), ('Put','spot')], axis=1)

opt.index.name = 'expDate'

## 以上得到完整的历史某日数据,格式简洁明了

return opt

# 做图展示某一天的隐含波动率微笑

def histDayPlotSmileVolatilityOpt50ETF(date):

cal = Calendar('China.SSE')

if not cal.isBizDay(date):

print date, ' is not a trading day!'

return

# Uqer 计算期权的风险数据

opt = histDayGreeksIVOpt50ETF(date)

spot = opt[('Call-Put', 'spot')].values[0]

# 下面展示波动率微笑

exp_dates = np.sort(opt.index.unique())

## ----------------------------------------------

fig = plt.figure(figsize=(10,8))

fig.set_tight_layout(True)

for i in range(exp_dates.shape[0]):

date = exp_dates[i]

ax = fig.add_subplot(2,2,i+1)

opt_date = opt[opt.index==date].set_index(('Call-Put', 'strike'))

opt_date.index.name = 'strike'

ax.plot(opt_date.index, opt_date[('Call', 'iv')], '-o')

ax.plot(opt_date.index, opt_date[('Put', 'iv')], '-s')

(y_min, y_max) = ax.get_ylim()

ax.plot([spot, spot], [y_min, y_max], '--')

ax.set_ylim(y_min, y_max)

ax.legend(['call', 'put'], loc=0)

ax.grid()

ax.set_xlabel(u"strike")

ax.set_ylabel(r"Implied Volatility")

plt.title(exp_dates[i])

```py