布林带交易策略

来源:https://uqer.io/community/share/5673d440228e5bab38c97782

from CAL.PyCAL import *

from datetime import *

import time

import pandas as pd

import numpy as np

import math

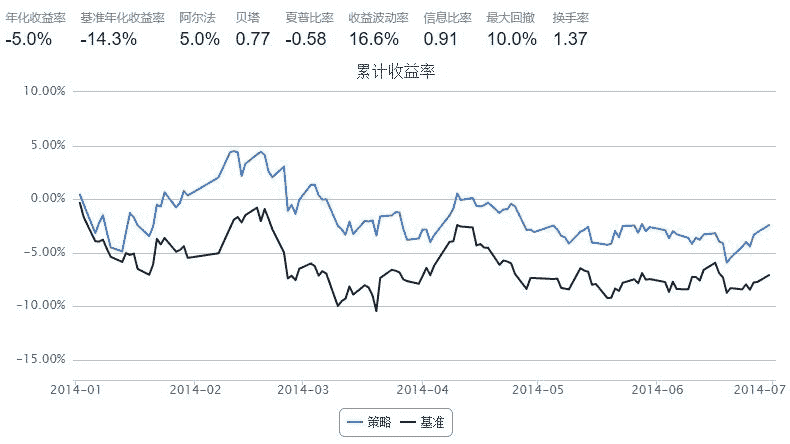

start = datetime(2014, 1, 1)

end = datetime(2014, 6, 30)

benchmark = 'HS300'

universe = set_universe('HS300')

capital_base = 100000

refresh_rate = 1

##########################################

t1 = 50 #MA周期

t2 = 30 #ROC周期

MaxBar = 0.75 #持仓周期最大时,首次卖出系数

##########################################

T = pd.Series(data=[t1],index = universe)

commission = Commission(buycost=0.0003, sellcost=0.0003)

def initialize(account):

pass

def handle_data(account):

#print account.current_date

cal = Calendar('China.SSE')

last_dayt1 = cal.advanceDate(account.current_date, str(-t1)+'B', BizDayConvention.Preceding).toDateTime() #计算出前t1个交易日

buylist = []

selllist = []

#取出当前交易日至前t1交易日之间的收盘价格数据

cp = DataAPI.MktEqudGet(secID=account.universe,ticker=u"",tradeDate=u"",beginDate=last_dayt1,endDate=account.current_date,field=[u"tradeDate",u"secID",u"closePrice"],pandas="1")

#根据持仓周期,更新MA计算周期T,持仓周期增加1,MA计算周期就减少1,最小为10

for stock in account.avail_secpos:

T[stock] = T[stock] - 1

if(T[stock] < 10):

T[stock] = 10

#计算t1周期MA

cpg = cp['closePrice'].groupby(cp['secID'])

ma = cpg.mean()

std = cpg.std()

#当股票当前价格突破布林线上轨,且ROC值大于0,买入

for stock in account.universe:

upband = ma[stock] + std[stock]

if(len(cp[cp.secID == stock]) > t2):

roc = (account.referencePrice[stock] - float(cp[cp.secID == stock][-t2:-t2+1]['closePrice'])) / float(cp[cp.secID == stock][-t2:-t2+1]['closePrice'])

if account.referencePrice[stock] > upband and roc > 0:

buylist.append(stock)

#当股票当前价格突破布林线中轨,且ROC值小于0,卖出

for stock in account.avail_secpos:

#根据股票的持仓周期计算,MA周期

MAT = np.mean(cp[cp.secID == stock][-T[stock]:]['closePrice'])

stdT = np.std(cp[cp.secID == stock][-T[stock]:]['closePrice'])

midband = MAT

downband = MAT - stdT

if(len(cp[cp.secID == stock]) > t2):

roc = (account.referencePrice[stock] - float(cp[cp.secID == stock][-t2:-t2+1]['closePrice'])) / float(cp[cp.secID == stock][-t2:-t2+1]['closePrice'])

if account.referencePrice[stock] < midband and roc < 0:

selllist.append(stock)

#买入策略,虚拟账户剩余金额按可买股票平均买入,0.95为成功成交系数

for i in buylist:

order(i, account.cash / len(buylist) / account.referencePrice[i] * 0.95)

#卖出策略,按持仓周期逐步卖出,持仓周期越长,第一次卖出越多,最多为3/4仓位,以10天为单位递减

for i in selllist:

x = (account.avail_secpos[i] * MaxBar*math.pow(0.5,T[i] // 10 -1) // 100) * 100

order(i,-x)

if(x == 100):

T[i] = t1