Competitive Securities

来源:https://uqer.io/community/share/54b5c373f9f06c276f651a18

策略实现:

-

计算三只同一行业股票过去4天内前3天的平均成交价(VWAP),这里选用的是中国平安 (601318.XSHG)、中国太保 (601601.XSHG)和中国人寿 (601628.XSHG)

-

当某两只股票的价格低于

0.995 * VWAP,同时另一只股票价格高于VWAP时,买入后者 -

当某两只股票的价格高于

1.025 * VWAP,同时另一只股票价格低于VWAP时,清空后者

import pandas as pd

import numpy as np

from datetime import datetime

from matplotlib import pylab

import quartz

import quartz.backtest as qb

import quartz.performance as qp

from quartz.api import *

"Competitive Securities"

start = pd.datetime(2012, 1, 1)

end = pd.datetime(2014, 12, 1)

bm = 'HS300'

universe = ['601601.XSHG', '601318.XSHG', '601628.XSHG']

csvs = []

capital_base = 5000

window = 4

threshold_dn = 0.995

threshold_up = 1.025

refresh_rate = 4

def initialize(account):

account.amount = 1000

account.universe = universe

add_history('hist', window)

def handle_data(account):

vwap3, price = {}, {}

for stk in account.universe:

if stk not in account.hist:

continue

vwap3[stk] = sum(account.hist[stk]['turnoverValue'][:3])/sum(account.hist[stk]['turnoverVol'][:3])

price[stk] = account.hist[stk].iloc[window-1,:]['closePrice']

if len(vwap3)!=3:

return

stk_0 = account.universe[0]

stk_1 = account.universe[1]

stk_2 = account.universe[2]

if price[stk_1] <= threshold_dn * vwap3[stk_1] and price[stk_2] <= threshold_dn * vwap3[stk_2] and price[stk_0] > vwap3[stk_0]:

order(stk_0, account.amount)

if price[stk_2] <= threshold_dn * vwap3[stk_2] and price[stk_0] <= threshold_dn * vwap3[stk_0] and price[stk_1] > vwap3[stk_1]:

order(stk_1, account.amount)

if price[stk_0] <= threshold_dn * vwap3[stk_0] and price[stk_1] <= threshold_dn * vwap3[stk_1] and price[stk_2] > vwap3[stk_2]:

order(stk_2, account.amount)

if price[stk_1] >= threshold_up * vwap3[stk_1] and price[stk_2] >= threshold_up * vwap3[stk_2] and price[stk_0] < vwap3[stk_0]:

order_to(stk_0, 0)

if price[stk_2] >= threshold_up * vwap3[stk_2] and price[stk_0] >= threshold_up * vwap3[stk_0] and price[stk_1] < vwap3[stk_1]:

order_to(stk_1, 0)

if price[stk_0] >= threshold_up * vwap3[stk_0] and price[stk_1] >= threshold_up * vwap3[stk_1] and price[stk_2] < vwap3[stk_2]:

order_to(stk_2, 0)

perf = qp.perf_parse(bt)

out_keys = ['annualized_return', 'volatility', 'information',

'sharpe', 'max_drawdown', 'alpha', 'beta']

for k in out_keys:

print '%s: %s' % (k, perf[k])

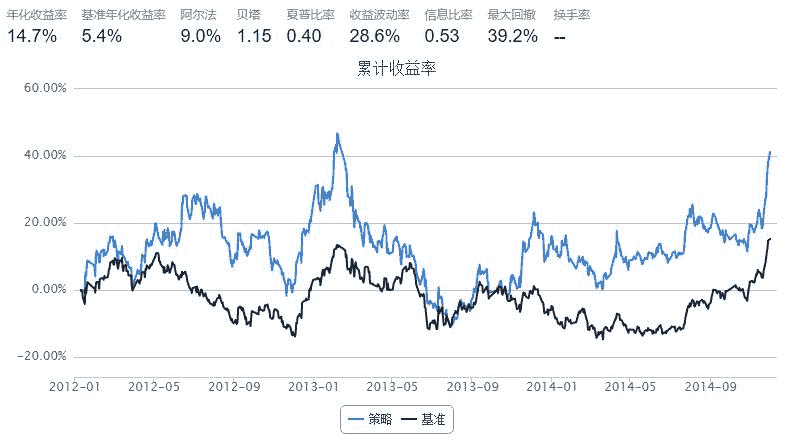

annualized_return: 0.14708285

volatility: 0.285959506628

information: 0.525131029268

sharpe: 0.395275720443

max_drawdown: 0.391931712536

alpha: 0.089663482291

beta: 1.15117691695

perf['cumulative_return'].plot()

perf['benchmark_cumulative_return'].plot()

pylab.legend(['current_strategy','HS300'])

<matplotlib.legend.Legend at 0x55bf290>