市值最小300指数

来源:https://uqer.io/community/share/5604fbe6f9f06c597665ef37

刷爆沪深300

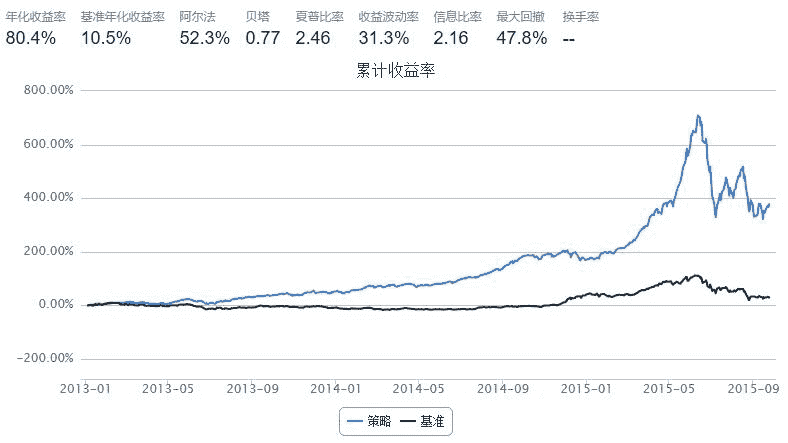

策略名称: 市值最小300指数

回测时间:2013-01-01 到 2015-09-24

调仓期 :20交易日

策略思想:找A股市场市值最小的300只股票,等权重构建最小300指数

注意 :

- 内存不够请自行缩短回测时间或universe

- 此贴有4个!!!

import pandas as pd

import numpy as np

from pandas import Series, DataFrame

start = '2013-01-01' # 回测起始时间

end = '2015-09-24' # 回测结束时间

benchmark = 'HS300' # 策略参考标准

universe0 = set_universe('A') # 证券池,支持股票和基金

universe1 = set_universe('HS300')

universe2 = set_universe('ZZ500')

universe = list(set(universe0).difference(set(universe1+universe2))) #最小市值股一定不在中证500和沪深300 pass

capital_base = 100000000 # 起始资金

freq = 'd' # 策略类型,'d'表示日间策略使用日线回测,'m'表示日内策略使用分钟线回测

refresh_rate = 20 # 调仓频率,表示执行handle_data的时间间隔,若freq = 'd'时间间隔的单位为交易日,若freq = 'm'时间间隔为分钟

def initialize(account): # 初始化虚拟账户状态

pass

def handle_data(account): # 每个交易日的买入卖出指令

total_money = account.referencePortfolioValue

prices = account.referencePrice

buylist = []

marketValue = DataFrame()

today = account.current_date.strftime('%Y%m%d')

for s in range(len(account.universe)/40 + 1):

if s == len(account.universe)/40:

temp_list = account.universe[s*40:]

else :

temp_list = account.universe[s*40:(s+1)*40]

#MktEqudGet接口一次最多选50个

try: #排除最后一次temp_list为零的可能

marketValue_temp = DataAPI.MktEqudGet(secID = temp_list,tradeDate= today, field=u"secID,marketValue",pandas="1")

except :

pass

marketValue = pd.concat([marketValue,marketValue_temp])

marketValue = marketValue.sort('marketValue',ascending=True).drop_duplicates('secID')

marketValue.set_index('secID',inplace=True)

marketValue = marketValue.dropna()

#排除新股发行日

for s in list(marketValue.index) :

if not (np.isnan(prices[s]) or prices[s] == 0) :

buylist.append(s)

if len(buylist) >= 300 :

break

sell_list = [x for x in account.valid_secpos if x not in buylist]

for stk in sell_list:

order_to(stk, 0)

for stk in buylist:

order_to(stk, int(total_money/300/prices[stk]/100)*100)

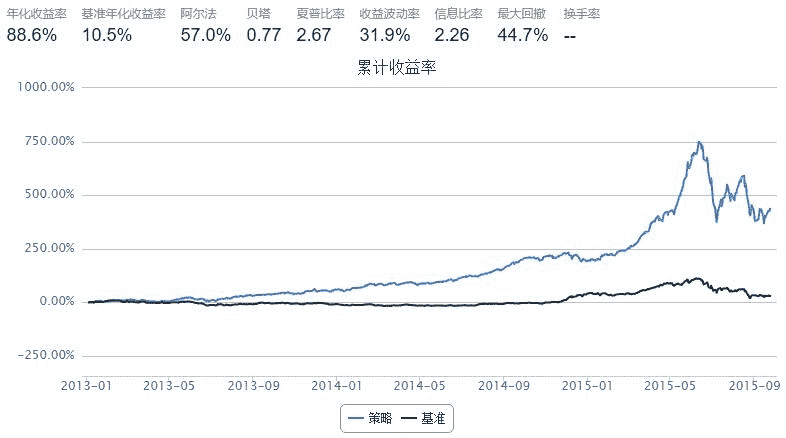

更改权重比例 :加权流通市值倒数(越小越买) 买买买!

import pandas as pd

import numpy as np

from pandas import Series, DataFrame

start = '2013-01-01' # 回测起始时间

end = '2015-09-24' # 回测结束时间

benchmark = 'HS300' # 策略参考标准

universe0 = set_universe('A') # 证券池,支持股票和基金

universe1 = set_universe('HS300')

universe2 = set_universe('ZZ500')

universe = list(set(universe0).difference(set(universe1+universe2)))

capital_base = 100000000 # 起始资金

freq = 'd' # 策略类型,'d'表示日间策略使用日线回测,'m'表示日内策略使用分钟线回测

refresh_rate = 20 # 调仓频率,表示执行handle_data的时间间隔,若freq = 'd'时间间隔的单位为交易日,若freq = 'm'时间间隔为分钟

def initialize(account): # 初始化虚拟账户状态

pass

def handle_data(account): # 每个交易日的买入卖出指令

total_money = account.referencePortfolioValue

prices = account.referencePrice

buylist = []

marketValue = DataFrame()

today = account.current_date.strftime('%Y%m%d')

for s in range(len(account.universe)/40 + 1):

if s == len(account.universe)/40:

temp_list = account.universe[s*40:]

else :

temp_list = account.universe[s*40:(s+1)*40]

#MktEqudGet接口一次最多选50个

try: #排除最后一次temp_list为零的可能

marketValue_temp = DataAPI.MktEqudGet(secID = temp_list,tradeDate= today, field=u"secID,marketValue,negMarketValue",pandas="1")

except :

pass

marketValue = pd.concat([marketValue,marketValue_temp])

marketValue = marketValue.sort('marketValue',ascending=True).drop_duplicates('secID')

marketValue.set_index('secID',inplace=True)

marketValue = marketValue.dropna()

#排除新股发行日

for s in list(marketValue.index) :

if not (np.isnan(prices[s]) or prices[s] == 0) :

buylist.append(s)

if len(buylist) >= 300 :

break

sell_list = [x for x in account.valid_secpos if x not in buylist]

for stk in sell_list:

order_to(stk, 0)

#加权流通市值倒数购买

weight_list = []

for stk in buylist:

weight_list.append(1.0/marketValue['negMarketValue'][stk])

temp_sum = 0

for temp in weight_list:

temp_sum += temp

weight_list = [x/temp_sum for x in weight_list]

i = 0

for stk in buylist:

order_to(stk, int(total_money*weight_list[i]/prices[stk]/100)*100)

i += 1

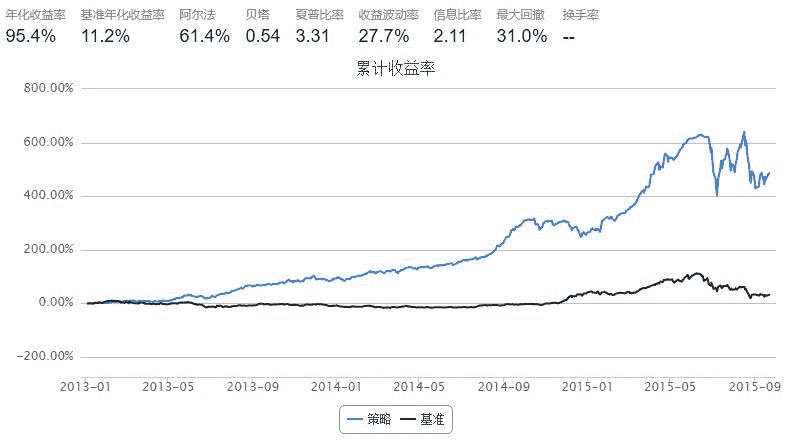

是不是在想賺钱分分钟了? 您有买300只个股的毛爷爷吗,啊! 〇_〇- . .

木有?我会告诉你买十只也很叼吗???

import pandas as pd

import numpy as np

from pandas import Series, DataFrame

start = '2013-01-01' # 回测起始时间

end = '2015-09-24' # 回测结束时间

benchmark = 'HS300' # 策略参考标准

universe0 = set_universe('A') # 证券池,支持股票和基金

universe1 = set_universe('HS300')

universe2 = set_universe('ZZ500')

universe = list(set(universe0).difference(set(universe1+universe2)))

capital_base = 100000000 # 起始资金

freq = 'd' # 策略类型,'d'表示日间策略使用日线回测,'m'表示日内策略使用分钟线回测

refresh_rate = 20 # 调仓频率,表示执行handle_data的时间间隔,若freq = 'd'时间间隔的单位为交易日,若freq = 'm'时间间隔为分钟

def initialize(account): # 初始化虚拟账户状态

pass

def handle_data(account): # 每个交易日的买入卖出指令

total_money = account.referencePortfolioValue

prices = account.referencePrice

buylist = []

marketValue = DataFrame()

today = account.current_date.strftime('%Y%m%d')

for s in range(len(account.universe)/40 + 1):

if s == len(account.universe)/40:

temp_list = account.universe[s*40:]

else :

temp_list = account.universe[s*40:(s+1)*40]

#MktEqudGet接口一次最多选50个

try: #排除最后一次temp_list为零的可能

marketValue_temp = DataAPI.MktEqudGet(secID = temp_list,tradeDate= today, field=u"secID,marketValue",pandas="1")

except :

pass

marketValue = pd.concat([marketValue,marketValue_temp])

marketValue = marketValue.sort('marketValue',ascending=True).drop_duplicates('secID')

marketValue.set_index('secID',inplace=True)

marketValue = marketValue.dropna()

#排除新股发行日

for s in list(marketValue.index) :

if not (np.isnan(prices[s]) or prices[s] == 0) :

buylist.append(s)

if len(buylist) >= 10 :

break

sell_list = [x for x in account.valid_secpos if x not in buylist]

for stk in sell_list:

order_to(stk, 0)

#只买最优十只

for stk in buylist:

order_to(stk, int(total_money/10/prices[stk]/100)*100)

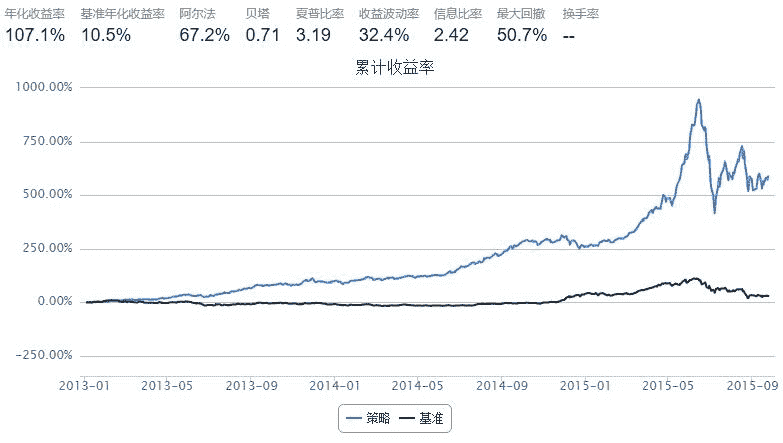

我会告诉你有庄家(机构持股)的股票更容易飞 ???

小注 :此策略中DataAPI.JY.EquInstShJYGet(恒生聚源接口)暂不开放!!!活跃用户自行申请

import pandas as pd

import numpy as np

from pandas import Series, DataFrame

start = '2013-01-01' # 回测起始时间

end = '2015-09-24' # 回测结束时间

benchmark = 'HS300' # 策略参考标准

universe0 = set_universe('A') # 证券池,支持股票和基金

universe1 = set_universe('HS300')

universe2 = set_universe('ZZ500')

universe = list(set(universe0).difference(set(universe1+universe2)))

capital_base = 100000000 # 起始资金

freq = 'd' # 策略类型,'d'表示日间策略使用日线回测,'m'表示日内策略使用分钟线回测

refresh_rate = 20 # 调仓频率,表示执行handle_data的时间间隔,若freq = 'd'时间间隔的单位为交易日,若freq = 'm'时间间隔为分钟

def initialize(account): # 初始化虚拟账户状态

pass

def handle_data(account): # 每个交易日的买入卖出指令

total_money = account.referencePortfolioValue

prices = account.referencePrice

buylist = []

marketValue = DataFrame()

today = account.current_date.strftime('%Y%m%d')

for s in range(len(account.universe)/40 + 1):

if s == len(account.universe)/40:

temp_list = account.universe[s*40:]

else :

temp_list = account.universe[s*40:(s+1)*40]

#MktEqudGet接口一次最多选50个

try: #排除最后一次temp_list为零的可能

marketValue_temp = DataAPI.MktEqudGet(secID = temp_list,tradeDate= today, field=u"secID,marketValue",pandas="1")

except :

pass

marketValue = pd.concat([marketValue,marketValue_temp])

marketValue = marketValue.sort('marketValue',ascending=True).drop_duplicates('secID')

marketValue.set_index('secID',inplace=True)

marketValue = marketValue.dropna()

# 机构持股 非第一天上市新股

for s in list(marketValue.index) :

try :

# 处理巨源的数据接口没有此股

temp = DataAPI.JY.EquInstShJYGet ( secID = s , field = u"instNrfaPct" , pandas = "1" )

except :

print account.current_date.strftime('%Y-%m-%d'),' ',s,' ','DataAPI.JY.EquInstShJYGet get wrong'

continue

#有机构持股 > 30%

if temp['instNrfaPct'][0] > 30 and not (np.isnan(prices[s]) or prices[s] == 0) :

buylist.append(s)

if len(buylist) >= 10 :

break

sell_list = [x for x in account.valid_secpos if x not in buylist]

for stk in sell_list:

order_to(stk, 0)

for stk in buylist:

order_to(stk, int(total_money/10/prices[stk]/100)*100)

呵呵,居然看完了,还不赶紧点赞克隆去賺钱!!!内存不够的还不赶紧签到 !!!