基于 VIX 指数的择时策略

来源:https://uqer.io/community/share/55b6152ff9f06c91fa18c5c9

波动率VIX指数是跟踪市场波动性的指数,一般通过标的期权的隐含波动率计算得来,以芝加哥期权交易所的VIX指数为例,如标的期权的隐含波动率越高,则VIX指数相应越高,一般而言,该指数反映出投资者愿意付出多少成本去对冲投资风险。业内认为,当VIX越高时,表示市场参与者预期后市波动程度会更加激烈,同时也反映其不安的心理状态;相反,VIX越低时,则反映市场参与者预期后市波动程度会趋于缓和的心态。因此,VIX又被称为投资人恐慌指标(The Investor Fear Gauge)。

中国波指是由上证所发布,用于衡量上证50ETF未来30日的预期波动。该指数是根据方差互换的原理,结合50ETF期权的实际运作特点,并通过对上证所交易的50ETF期权价格的计算编制而得。网址为: http://www.sse.com.cn/assortment/derivatives/options/volatility/

本文中,基于优矿平台,自己尝试计算了日间的中国波指,并将其用在了华夏上证50的择时买卖上,以验证VIX指数对未来的预测性

由于上证所未发布其iVIX计算方法,所以此处的计算基于CBOE发布的方法,具体参见: http://www.cboe.com/micro/vix/part2.aspx

策略思路

- 当VIX指数快速上升时,表示市场恐慌情绪蔓延,产生卖出信号

- 当VIX指数快速下降时,恐慌情绪有所舒缓,产生买入信号

- 卖出买入信号均用来买卖华夏上证50ETF基金

注:国内唯一一只期权上证50ETF期权,跟踪标的为华夏上证50ETF(510050)基金

1. 计算历史VIX指数

from matplotlib import pylab

import numpy as np

import pandas as pd

import DataAPI

import seaborn as sns

sns.set_style('white')

from CAL.PyCAL import *

from pandas import Series, DataFrame, concat

import pandas as pd

import numpy as np

import seaborn as sns

sns.set_style('white')

from matplotlib import pylab

import time

import math

def getHistDayOptions(var, date):

# 使用DataAPI.OptGet,拿到已退市和上市的所有期权的基本信息;

# 同时使用DataAPI.MktOptdGet,拿到历史上某一天的期权成交信息;

# 返回历史上指定日期交易的所有期权信息,包括:

# optID varSecID contractType strikePrice expDate tradeDate closePrice

# 以optID为index。

vixDateStr = date.toISO().replace('-', '')

optionsMkt = DataAPI.MktOptdGet(tradeDate = vixDateStr, field = [u"optID", "tradeDate", "closePrice"], pandas = "1")

optionsMkt = optionsMkt.set_index(u"optID")

optionsMkt.closePrice.name = u"price"

optionsID = map(str, optionsMkt.index.values.tolist())

fieldNeeded = ["optID", u"varSecID", u'contractType', u'strikePrice', u'expDate']

optionsInfo = DataAPI.OptGet(optID=optionsID, contractStatus = [u"DE", u"L"], field=fieldNeeded, pandas="1")

optionsInfo = optionsInfo.set_index(u"optID")

options = concat([optionsInfo, optionsMkt], axis=1, join='inner').sort_index()

return options[options.varSecID==var]

def getNearNextOptExpDate(options, vixDate):

# 找到options中的当月和次月期权到期日;

# 用这两个期权隐含的未来波动率来插值计算未来30隐含波动率,是为市场恐慌指数VIX;

# 如果options中的最近到期期权离到期日仅剩1天以内,则抛弃这一期权,改

# 选择次月期权和次月期权之后第一个到期的期权来计算。

# 返回的near和next就是用来计算VIX的两个期权的到期日

optionsExpDate = Series(options.expDate.values.ravel()).unique().tolist()

near = min(optionsExpDate)

optionsExpDate.remove(near)

if Date.parseISO(near) - vixDate < 1:

near = min(optionsExpDate)

optionsExpDate.remove(near)

next = min(optionsExpDate)

return near, next

def getStrikeMinCallMinusPutClosePrice(options):

# options 中包括计算某日VIX的call和put两种期权,

# 对每个行权价,计算相应的call和put的价格差的绝对值,

# 返回这一价格差的绝对值最小的那个行权价,

# 并返回该行权价对应的call和put期权价格的差

call = options[options.contractType==u"CO"].set_index(u"strikePrice").sort_index()

put = options[options.contractType==u"PO"].set_index(u"strikePrice").sort_index()

callMinusPut = call.closePrice - put.closePrice

strike = abs(callMinusPut).idxmin()

priceDiff = callMinusPut[strike]

return strike, priceDiff

def calSigmaSquare(options, FF, R, T):

# 计算某个到期日期权对于VIX的贡献sigma;

# 输入为期权数据options,FF为forward index price,

# R为无风险利率, T为期权剩余到期时间

callAll = options[options.contractType==u"CO"].set_index(u"strikePrice").sort_index()

putAll = options[options.contractType==u"PO"].set_index(u"strikePrice").sort_index()

callAll['deltaK'] = 0.05

putAll['deltaK'] = 0.05

# Interval between strike prices

index = callAll.index

if len(index) < 3:

callAll['deltaK'] = index[-1] - index[0]

else:

for i in range(1,len(index)-1):

callAll['deltaK'].ix[index[i]] = (index[i+1]-index[i-1])/2.0

callAll['deltaK'].ix[index[0]] = index[1]-index[0]

callAll['deltaK'].ix[index[-1]] = index[-1] - index[-2]

index = putAll.index

if len(index) < 3:

putAll['deltaK'] = index[-1] - index[0]

else:

for i in range(1,len(index)-1):

putAll['deltaK'].ix[index[i]] = (index[i+1]-index[i-1])/2.0

putAll['deltaK'].ix[index[0]] = index[1]-index[0]

putAll['deltaK'].ix[index[-1]] = index[-1] - index[-2]

call = callAll[callAll.index > FF]

put = putAll[putAll.index < FF]

FF_idx = FF

if not put.empty:

FF_idx = put.index[-1]

put['closePrice'].iloc[-1] = (putAll.ix[FF_idx].closePrice + callAll.ix[FF_idx].closePrice)/2.0

callComponent = call.closePrice*call.deltaK/call.index/call.index

putComponent = put.closePrice*put.deltaK/put.index/put.index

sigma = (sum(callComponent)+sum(putComponent))*np.exp(T*R)*2/T

sigma = sigma - (FF/FF_idx - 1)**2/T

return sigma

def calDayVIX(optionVarSecID, vixDate):

# 利用CBOE的计算方法,计算历史某一日的未来30日期权波动率指数VIX

# The risk-free interest rates

R_near = 0.06

R_next = 0.06

# 拿取所需期权信息

options = getHistDayOptions(optionVarSecID, vixDate)

termNearNext = getNearNextOptExpDate(options, vixDate)

optionsNearTerm = options[options.expDate == termNearNext[0]]

optionsNextTerm = options[options.expDate == termNearNext[1]]

# time to expiration

T_near = (Date.parseISO(termNearNext[0]) - vixDate)/365.0

T_next = (Date.parseISO(termNearNext[1]) - vixDate)/365.0

# the forward index prices

nearPriceDiff = getStrikeMinCallMinusPutClosePrice(optionsNearTerm)

nextPriceDiff = getStrikeMinCallMinusPutClosePrice(optionsNextTerm)

near_F = nearPriceDiff[0] + np.exp(T_near*R_near)*nearPriceDiff[1]

next_F = nextPriceDiff[0] + np.exp(T_next*R_next)*nextPriceDiff[1]

# 计算不同到期日期权对于VIX的贡献

near_sigma = calSigmaSquare(optionsNearTerm, near_F, R_near, T_near)

next_sigma = calSigmaSquare(optionsNextTerm, next_F, R_next, T_next)

# 利用两个不同到期日的期权对VIX的贡献sig1和sig2,

# 已经相应的期权剩余到期时间T1和T2;

# 差值得到并返回VIX指数(%)

w = (T_next - 30.0/365.0)/(T_next - T_near)

vix = T_near*w*near_sigma + T_next*(1 - w)*next_sigma

return 100*np.sqrt(vix*365.0/30.0)

def getHistVIX(beginDate, endDate):

# 计算历史一段时间内的VIX指数并返回

optionVarSecID = u"510050.XSHG"

cal = Calendar('China.SSE')

dates = cal.bizDatesList(beginDate, endDate)

dates = map(Date.toDateTime, dates)

histVIX = pd.DataFrame(0.0, index=dates, columns=['VIX'])

histVIX.index.name = 'date'

for date in histVIX.index:

histVIX['VIX'][date] = calDayVIX(optionVarSecID, Date.fromDateTime(date))

return histVIX

def getDayVIX(date):

optionVarSecID = u"510050.XSHG"

return calDayVIX(optionVarSecID, date)

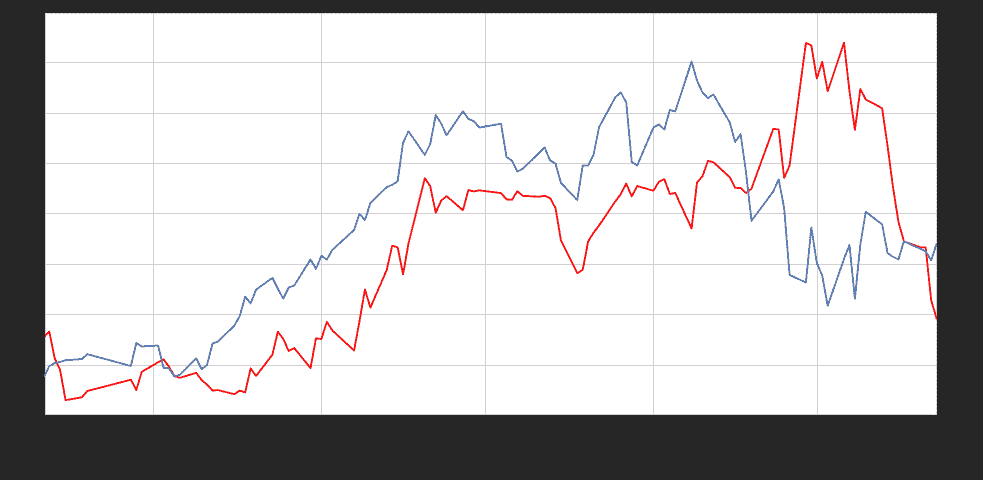

2. VIX指数与华夏上证50ETF基金的走势对比

secID = '510050.XSHG'

begin = Date(2015, 2, 9)

end = Date(2015, 7, 23)

# 历史VIX

histVIX = getHistVIX(begin, end)

# 华夏上证50ETF

etf = DataAPI.MktFunddGet(secID, beginDate=begin.toISO().replace('-', ''), endDate=end.toISO().replace('-', ''), field=['tradeDate', 'closePrice'])

etf['tradeDate'] = pd.to_datetime(etf['tradeDate'])

etf = etf.set_index('tradeDate')

font.set_size(12)

pylab.figure(figsize = (16,8))

ax1 = histVIX.plot(x=histVIX.index, y='VIX', style='r')

ax1.set_xlabel(u'日期', fontproperties=font)

ax1.set_ylabel(u'VIX(%)', fontproperties=font)

ax2 = ax1.twinx()

ax2.plot(etf.index,etf.closePrice)

ax2.set_ylabel(u'ETF Price', fontproperties=font)

<matplotlib.text.Text at 0x5a66390>

关于VIX,比较成熟的美国市场中,标普500指数和相应的VIX之间呈负相关性。具体可以参照CBOE的数据:http://www.cboe.com/micro/vix/part3.aspx

这可以理解为:

- 当VIX越高时,表示市场参与者预期后市波动程度会更加激烈,所以谨慎持仓,甚至逐渐减仓;

- 相反,VIX越低时,市场参与者预期后市波动程度会趋于缓和,开始放心投资股市。

上图中的中国市场VIX指数与华夏上证50ETF走势对比中,我们不难发现以下几点:

- 上证50ETF期权于2月9日上市,之后一个月VIX稳定在低位运行,同时市场也表现出稳定的态势

- 3月下旬到5月初一段时间,VIX指数显著上升,表示市场认为后期震荡会加剧,但这种恐慌淹没在牛市大潮中

- 5月到6月VIX高位运行,但似乎没有引起市场的足够重视

- 6月中的股市大跌开始后,VIX指数快速上升到接近60

- 7月时候,市场认可国家救市决心,VIX开始从高位迅速下降,股指也日趋稳定

可以看出,VIX指数在和股指的并驾齐驱中总是慢人一步,没法充分表现出股指在六月极高位时候市场的不安;实际上,国内期权市场建立不足半年,期权流动性并不够大,导致基于期权市场的VIX指数对于中国股市的预测并不如成熟市场一样流畅

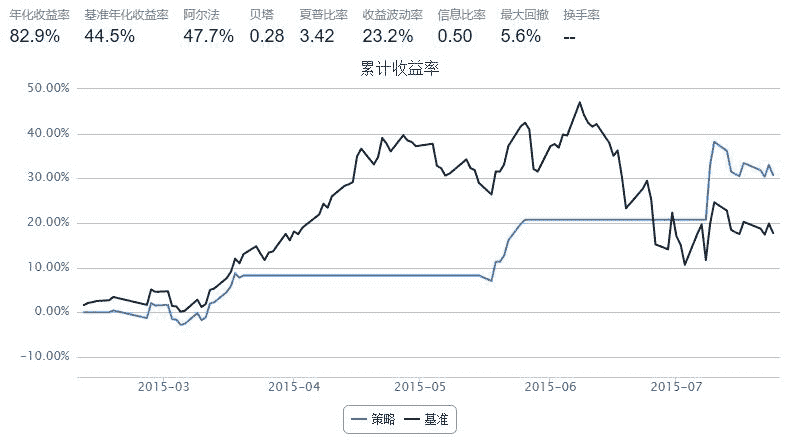

3. 基于VIX指数的择时策略示例

start = datetime(2015, 2, 9) # 回测起始时间

end = datetime(2015, 7, 26) # 回测结束时间

benchmark = '510050.XSHG' # 策略参考标准

universe = ['510050.XSHG'] # 股票池

capital_base = 100000 # 起始资金

commission = Commission(0.0,0.0)

window_short = 1

window_long = 5

longest_history = 1

SD = 0.08

histVIX['short_window'] = pd.rolling_mean(histVIX['VIX'], window=window_short)

histVIX['long_window'] = pd.rolling_mean(histVIX['VIX'], window=window_long)

def initialize(account): # 初始化虚拟账户状态

account.fund = universe[0]

def handle_data(account): # 每个交易日的买入卖出指令

hist = account.get_history(longest_history)

fund = account.fund

# 获取回测当日的前一天日期

dt = Date.fromDateTime(account.current_date)

cal = Calendar('China.IB')

lastTDay = cal.advanceDate(dt,'-1B',BizDayConvention.Preceding) #计算出前一个交易日期

last_day_str = lastTDay.strftime("%Y-%m-%d")

# 计算买入卖出信号

try:

short_mean = histVIX['short_window'].loc[last_day_str] # 计算短均线值

long_mean = histVIX['long_window'].loc[last_day_str] # 计算长均线值

long_flag = True if (short_mean - long_mean) < -SD * long_mean else False

short_flag = True if (short_mean - long_mean) > SD * long_mean else False

except:

long_flag = False

short_flag = False

if long_flag:

if account.position.secpos.get(fund, 0) == 0:

# 空仓时全仓买入,买入股数为100的整数倍

approximationAmount = int(account.cash / hist[fund]['closePrice'][-1]/100.0) * 100

order(fund, approximationAmount)

elif short_flag:

# 卖出时,全仓清空

if account.position.secpos.get(fund, 0) >= 0:

order_to(fund, 0)

可以看出:

- 基于VIX指数高位时空仓、低位时进场的策略,可以比较有效地避开股指大跌的风险

- 但由于国内期权市场流动性不足,VIX指数并不能有效反应市场的情绪,导致我们也错过了很多牛市的蛋糕