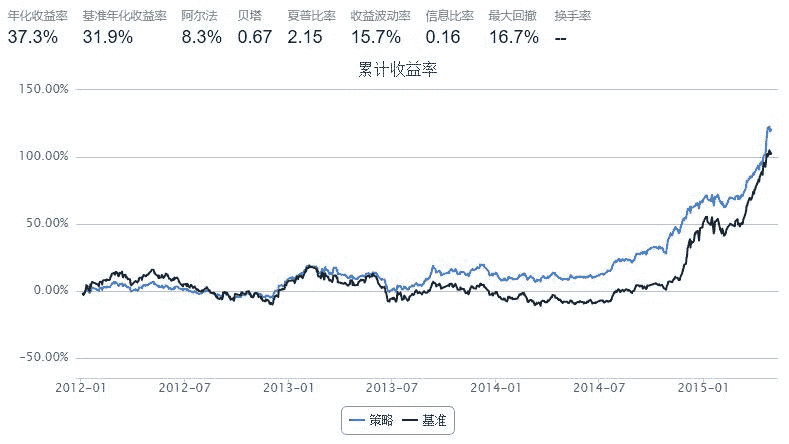

简单低波动率指数

来源:https://uqer.io/community/share/5566a9b8f9f06c6641e97aea

金融市场的波动性加剧,为了提供更好的下行保护,低波动率的Smart Beta策略受到了广泛的欢迎

代表指数

目标指数

HS300

选股

计算目标指数股票池中样本股过去100个交易日中的历史波动率,并挑选其中波动率最低的50只股票作为指数的成分股

加权

与传统指数市值加权不同,本指数根据股票波动率倒数为个股权重

实现细节

通过DataAPI.EquRetudGet获取不考虑现金红利再投资情况下的每日收益率,波动率为调仓前100个交易日的日收益率标准差

import numpy as np

import pandas as pd

start = '2012-01-01' # 回测起始时间

end = '2015-05-01' # 回测结束时间

benchmark = 'HS300' # 策略参考标准

universe = set_universe('HS300') # 证券池,回测支持股票和基金

capital_base = 10000000 # 起始资金

refresh_rate = 100 # 调仓频率,即每 refresh_rate 个交易日执行一次 handle_data() 函数

cal = Calendar('China.SSE')

def initialize(account): # 初始化虚拟账户状态

pass

def handle_data(account): # 每个交易日的买入卖出指令

volatility_res = {}

cal_today = Date.fromDateTime(account.current_date)

start_day = cal.advanceDate(cal_today, '-101B', BizDayConvention.Following)

yesterday = cal.advanceDate(cal_today, '-1B', BizDayConvention.Following)

for stk in universe:

try:

data = DataAPI.EquRetudGet(ticker=stk[:6], beginDate=Date.toDateTime(start_day).strftime('%Y%m%d'), endDate=Date.toDateTime(yesterday).strftime('%Y%m%d'), field=['ticker',"dailyReturnNoReinv"])

revenue = data['dailyReturnNoReinv']

volatility_res[stk] = np.std(revenue)

except:

universe.remove(stk)

res = pd.Series(volatility_res).order()[:50]

temp = np.ones(50)

res = np.divide(temp, res)

weight_sum = res.values.sum()

order_list = dict(res/weight_sum)

for stk in account.valid_secpos:

order_to(stk, 0)

for s, weight in order_list.iteritems():

if account.referencePrice[s] == 0:

continue

order(s, capital_base*weight/account.referencePrice[s])

print "Benchmark Volatility : ", perf['benchmark_volatility']

print "Index Volatility : ", perf['volatility']

Benchmark Volatility : 0.213927304422

Index Volatility : 0.156413355501

结果分析

通过以上结果我们可以看到,该策略alpha极小,beta较大,并显著减小了波动率