12.1 order book 分析 · 基于高频 limit order book 数据的短程价格方向预测—— via multi-class SVM

来源:https://uqer.io/community/share/5660665bf9f06c6c8a91b1a0

摘要:

下面的内容是基于文献Modeling high-frequency limit order book dynamics with support vector machines的框架写的,由于高频数据粗粒度依然有限,只能实现了部分内容。若需要完整理解这个问题以及实现方法,请阅读上述的文献。下面我会简单介绍一下整个框架的内容。

模型构造

作者使用Message book以及Order book作为数据来源,通联没有前者的数据,因此后面的部分只涉及到level1买卖5档的order book数据作为模型的输入。这里我只实现了通过order book数据预测mid price的方向,包括向上,向下,以及不变。对于bid-ask spread crossing的方法相似,我暂时就不放上来了。

特征选择

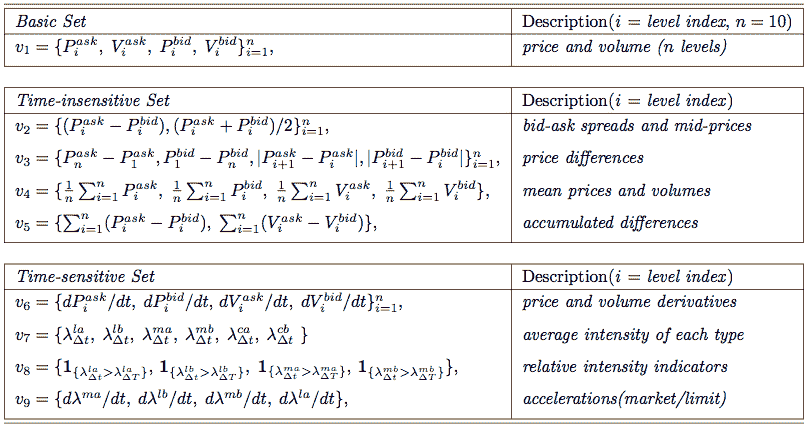

对order book数据做处理后,可以提取到我们需要的特征向量。总的特征分为三类:基本、时间不敏感和时间敏感三类,这里我们能从数据中获得全部的基本和时间不敏感特征,以及部分时间敏感特征,具体的见图片,或者进一步阅读文献。

#importing package

import numpy as np

import pandas as pd

from matplotlib import pyplot as plt

from sklearn import svm

from CAL.PyCAL import *

#global parameter for model

date = '20151130'

securityID = '000002.XSHE' #万科A

trainSetNum = 900

testSetNum = 600

#loading LOB data

dataSet = DataAPI.MktTicksHistOneDayGet(securityID=securityID, date=date,pandas='1')

#Features representation

##Basic Set

###V1: price and volume (10 levels)

featV1 = dataSet[['askPrice1','askPrice2','askPrice3','askPrice4','askPrice5','askVolume1','askVolume2','askVolume3','askVolume4','askVolume5','bidPrice1','bidPrice2','bidPrice3','bidPrice4','bidPrice5','bidVolume1','bidVolume2','bidVolume3','bidVolume4','bidVolume5']]

featV1 = np.array(featV1)

##Time-insensitive Set

###V2: bid-ask spread and mid-prices

temp1 = featV1[:,0:5] - featV1[:,10:15]

temp2 = (featV1[:,0:5] + featV1[:,10:15])*0.5

featV2 = np.zeros([temp1.shape[0],temp1.shape[1]+temp2.shape[1]])

featV2[:,0:temp1.shape[1]] = temp1

featV2[:,temp1.shape[1]:] = temp2

###V3: price differences

temp1 = featV1[:,4] - featV1[:,0]

temp2 = featV1[:,10] - featV1[:,14]

temp3 = abs(featV1[:,1:5] - featV1[:,0:4])

temp4 = abs(featV1[:,11:15] - featV1[:,10:14])

featV3 = np.zeros([temp1.shape[0],1+1+temp3.shape[1]+temp4.shape[1]])

featV3[:,0] = temp1

featV3[:,1] = temp2

featV3[:,2:2+temp3.shape[1]] = temp3

featV3[:,2+temp3.shape[1]:] = temp4

###V4: mean prices and volumns

temp1 = np.mean(featV1[:,0:5],1)

temp2 = np.mean(featV1[:,10:15],1)

temp3 = np.mean(featV1[:,5:10],1)

temp4 = np.mean(featV1[:,15:],1)

featV4 = np.zeros([temp1.shape[0],1+1+1+1])

featV4[:,0] = temp1

featV4[:,1] = temp2

featV4[:,2] = temp3

featV4[:,3] = temp4

###V5: accumulated differences

temp1 = np.sum(featV2[:,0:5],1)

temp2 = np.sum(featV1[:,5:10] - featV1[:,15:],1)

featV5 = np.zeros([temp1.shape[0],1+1])

featV5[:,0] = temp1

featV5[:,1] = temp2

##Time-insensitive Set

###V6: price and volume derivatives

temp1 = featV1[1:,0:5] - featV1[:-1,0:5]

temp2 = featV1[1:,10:15] - featV1[:-1,10:15]

temp3 = featV1[1:,5:10] - featV1[:-1,5:10]

temp4 = featV1[1:,15:] - featV1[:-1,15:]

featV6 = np.zeros([temp1.shape[0]+1,temp1.shape[1]+temp2.shape[1]+temp3.shape[1]+temp4.shape[1]]) #由于差分,少掉一个数据,此处补回

featV6[1:,0:temp1.shape[1]] = temp1

featV6[1:,temp1.shape[1]:temp1.shape[1]+temp2.shape[1]] = temp2

featV6[1:,temp1.shape[1]+temp2.shape[1]:temp1.shape[1]+temp2.shape[1]+temp3.shape[1]] = temp3

featV6[1:,temp1.shape[1]+temp2.shape[1]+temp3.shape[1]:] = temp4

##combining the features

feat = np.zeros([featV1.shape[0],sum([featV1.shape[1],featV2.shape[1],featV3.shape[1],featV4.shape[1],featV5.shape[1],featV6.shape[1]])])

feat[:,:featV1.shape[1]] = featV1

feat[:,featV1.shape[1]:featV1.shape[1]+featV2.shape[1]] = featV2

feat[:,featV1.shape[1]+featV2.shape[1]:featV1.shape[1]+featV2.shape[1]+featV3.shape[1]] = featV3

feat[:,featV1.shape[1]+featV2.shape[1]+featV3.shape[1]:featV1.shape[1]+featV2.shape[1]+featV3.shape[1]+featV4.shape[1]] = featV4

feat[:,featV1.shape[1]+featV2.shape[1]+featV3.shape[1]+featV4.shape[1]:featV1.shape[1]+featV2.shape[1]+featV3.shape[1]+featV4.shape[1]+featV5.shape[1]] = featV5

feat[:,featV1.shape[1]+featV2.shape[1]+featV3.shape[1]+featV4.shape[1]+featV5.shape[1]:] = featV6

##normalizing the feature

numFeat = feat.shape[1]

meanFeat = feat.mean(axis=1)

meanFeat.shape = [meanFeat.shape[0],1]

stdFeat = feat.std(axis=1)

stdFeat.shape = [stdFeat.shape[0],1]

normFeat = (feat - meanFeat.repeat(numFeat,axis=1))/stdFeat.repeat(numFeat,axis=1)

#print(normFeat)

api.wmcloud.com 443

数据标注

选择时间间隔为通联能获取的最小时间间隔(3s),

- 若下一个单位时刻mid price大于此时的mid price,则标注为向上,

- 若下一个单位时刻mid price小于此时的mid price,则标注为向下,

- 若下一个单位时刻mid price等于此时的mid price,则标注为不变,

##mid-price trend of dataset:upward(0),downward(1) or stationary(2)

upY = featV2[1:,5] > featV2[:-1,5]

upY = np.append(upY,0)

numUp = sum(upY)

downY = featV2[1:,5] < featV2[:-1,5]

downY = np.append(downY,0)

numDown = sum(downY)

statY = featV2[1:,5] == featV2[:-1,5]

statY = np.append(statY,0)

numStat = sum(statY)

#Y = np.zeros([upY.shape[0],3])

#Y[:,0] = upY

#Y[:,1] = downY

#Y[:,2] = statY

pUp = np.where(upY==1)[0]

pDown = np.where(downY==1)[0]

pStat = np.where(statY==1)[0]

multiY = np.zeros([upY.shape[0],1])

multiY[pUp] = 0

multiY[pDown] = 1

multiY[pStat] = 2

##divide the dataset into trainSet, and testSst

numTrain = 1200

numTest = 500

#rebalance the radio of upward, downward and stationary data

numTrainUp = 250

numTrainDown = 250

numTrainStat = 400

pUpTrain = pUp[:numTrainUp]

pDownTrain = pDown[:numTrainDown]

pStatTrain = pStat[:numTrainStat]

pTrainTemp = np.append(pUpTrain,pDownTrain)

pTrain = np.append(pTrainTemp,pStatTrain)

trainSet = normFeat[pTrain,:]

#trainSet = normFeat[1:numTrain+1,:]

testSet = normFeat[numTrain+1:numTrain+numTest+1,:]

#trainY = Y[1:numTrain+1,:]

trainMultiYTemp = np.append(multiY[pUpTrain],multiY[pDownTrain])

trainMultiY = np.append(trainMultiYTemp,multiY[pStatTrain])

#trainMultiY = multiY[1:numTrain+1]

testMultiY = multiY[numTrain+1:numTrain+numTest+1]

分类模型

基于one vs all的multi-class SVM,这里我没有对参数做过多调整,因此看到的模型事实上非常简陋。有兴趣的话也可以用forest tree等ML方法尝试。

##training a multi-class svm model

Model = svm.LinearSVC(C=2.)

Model.fit(trainSet,trainMultiY)

pred = Model.predict(testSet)

ap = Model.score(testSet,testMultiY)

print(ap)

0.522

结果

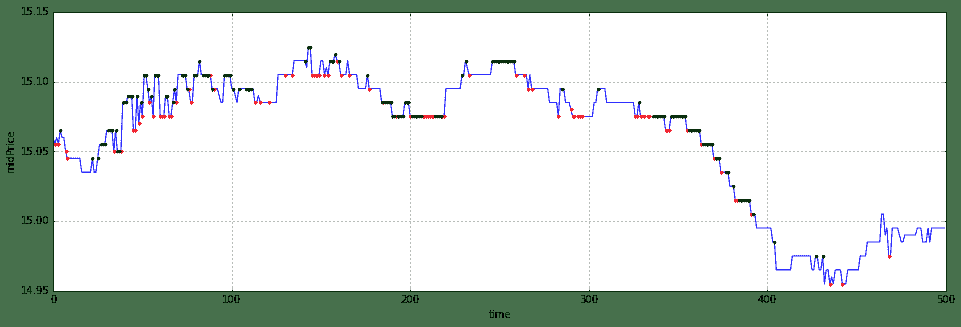

我这里拿了11月30日的万科A作为数据来源来预测。之所以拿万科A,是因为我从11月上旬就开始看好这只股票,结果在中旬的时候没有拿住,低位没有补进,谁知道月底就起飞了,让我又爱又恨。我在最后画出了预测结果,蓝线是测试集中的mid price时间序列,红点表示模型预测下一时刻方向向上,绿点表示模型预测下一时刻方向向下,没有画点表示预测方向不变。

testMidPrice = featV2[numTrain+1:numTrain+numTest+1,5]

pUpTest = np.where(pred==0)[0]

pDownTest = np.where(pred==1)[0]

pStatTest = np.where(pred==2)[0]

plt.figure(figsize=(16,5))

plt.plot(range(numTest),testMidPrice,'b-',pUpTest,testMidPrice[pUpTest],'r.',pDownTest,testMidPrice[pDownTest],'g.')

plt.grid()

plt.xlabel('time')

plt.ylabel('midPrice')

<matplotlib.text.Text at 0x6f8d2d0>

题外话

现在你看到的是一个极为粗糙的东西,原论文的框架远远比这个复杂,包括对训练集的交叉验证,以及数据的更新替代,bid-ask spread crossing,以及基于此的toy策略(当然这么高频的操作在平台上暂时也实现不了:))等等等等都没有实现。这里我只是选取了前1200个数据作了normalization和rebalance后来预测后500个数据。我现在研二忙成狗,也只能晚上写一写,还得赶着发完论文以后赶紧找实习,所以以后有机会也许再放一个更精细的版本上来。最后感谢通联的朋友特地给我开了历史高频的接口~