Conservative Bollinger Bands

来源:https://uqer.io/community/share/548575def9f06c8e77336728

import quartz

import quartz.backtest as qb

import quartz.performance as qp

from quartz.api import *

import pandas as pd

import numpy as np

from datetime import datetime

from matplotlib import pylab

import talib

start = datetime(2011, 1, 1)

end = datetime(2014, 8, 1)

benchmark = 'HS300'

universe = ['601398.XSHG', '600028.XSHG', '601988.XSHG', '600036.XSHG', '600030.XSHG',

'601318.XSHG', '600000.XSHG', '600019.XSHG', '600519.XSHG', '601166.XSHG']

capital_base = 1000000

refresh_rate = 5

window = 200

def initialize(account):

account.amount = 10000

account.universe = universe

add_history('hist', window)

def handle_data(account, data):

for stk in account.universe:

prices = account.hist[stk]['closePrice']

if prices is None:

return

mu = prices.mean()

sd = prices.std()

upper = mu + 1*sd

middle = mu

lower = mu - 1*sd

cur_pos = account.position.stkpos.get(stk, 0)

cur_prc = prices[-1]

if cur_prc > upper and cur_pos >= 0:

order_to(stk, 0)

if cur_prc < lower and cur_pos <= 0:

order(stk, account.amount)

bt

| tradeDate | cash | stock_position | portfolio_value | benchmark_return | blotter | |

|---|---|---|---|---|---|---|

| 0 | 2011-01-04 | 1000000 | {} | 1000000 | 0.000000 | [] |

| 1 | 2011-01-05 | 1000000 | {} | 1000000 | -0.004395 | [] |

| 2 | 2011-01-06 | 1000000 | {} | 1000000 | -0.005044 | [] |

| 3 | 2011-01-07 | 1000000 | {} | 1000000 | 0.002209 | [] |

| 4 | 2011-01-10 | 1000000 | {} | 1000000 | -0.018454 | [] |

| 5 | 2011-01-11 | 1000000 | {} | 1000000 | 0.005384 | [] |

| 6 | 2011-01-12 | 1000000 | {} | 1000000 | 0.005573 | [] |

| 7 | 2011-01-13 | 1000000 | {} | 1000000 | -0.000335 | [] |

| 8 | 2011-01-14 | 1000000 | {} | 1000000 | -0.015733 | [] |

| 9 | 2011-01-17 | 1000000 | {} | 1000000 | -0.038007 | [] |

| 10 | 2011-01-18 | 1000000 | {} | 1000000 | 0.001109 | [] |

| 11 | 2011-01-19 | 1000000 | {} | 1000000 | 0.022569 | [] |

| 12 | 2011-01-20 | 1000000 | {} | 1000000 | -0.032888 | [] |

| 13 | 2011-01-21 | 1000000 | {} | 1000000 | 0.013157 | [] |

| 14 | 2011-01-24 | 1000000 | {} | 1000000 | -0.009795 | [] |

| 15 | 2011-01-25 | 1000000 | {} | 1000000 | -0.005273 | [] |

| 16 | 2011-01-26 | 1000000 | {} | 1000000 | 0.013536 | [] |

| 17 | 2011-01-27 | 1000000 | {} | 1000000 | 0.016128 | [] |

| 18 | 2011-01-28 | 1000000 | {} | 1000000 | 0.003393 | [] |

| 19 | 2011-01-31 | 1000000 | {} | 1000000 | 0.013097 | [] |

| 20 | 2011-02-01 | 1000000 | {} | 1000000 | 0.000252 | [] |

| 21 | 2011-02-09 | 1000000 | {} | 1000000 | -0.011807 | [] |

| 22 | 2011-02-10 | 1000000 | {} | 1000000 | 0.020788 | [] |

| 23 | 2011-02-11 | 1000000 | {} | 1000000 | 0.005410 | [] |

| 24 | 2011-02-14 | 1000000 | {} | 1000000 | 0.031461 | [] |

| 25 | 2011-02-15 | 1000000 | {} | 1000000 | -0.000457 | [] |

| 26 | 2011-02-16 | 1000000 | {} | 1000000 | 0.009590 | [] |

| 27 | 2011-02-17 | 1000000 | {} | 1000000 | -0.000807 | [] |

| 28 | 2011-02-18 | 1000000 | {} | 1000000 | -0.010484 | [] |

| 29 | 2011-02-21 | 1000000 | {} | 1000000 | 0.014332 | [] |

| 30 | 2011-02-22 | 1000000 | {} | 1000000 | -0.028954 | [] |

| 31 | 2011-02-23 | 1000000 | {} | 1000000 | 0.003529 | [] |

| 32 | 2011-02-24 | 1000000 | {} | 1000000 | 0.005101 | [] |

| 33 | 2011-02-25 | 1000000 | {} | 1000000 | 0.002094 | [] |

| 34 | 2011-02-28 | 1000000 | {} | 1000000 | 0.013117 | [] |

| 35 | 2011-03-01 | 1000000 | {} | 1000000 | 0.004733 | [] |

| 36 | 2011-03-02 | 1000000 | {} | 1000000 | -0.003562 | [] |

| 37 | 2011-03-03 | 1000000 | {} | 1000000 | -0.006654 | [] |

| 38 | 2011-03-04 | 1000000 | {} | 1000000 | 0.015193 | [] |

| 39 | 2011-03-07 | 1000000 | {} | 1000000 | 0.019520 | [] |

| 40 | 2011-03-08 | 1000000 | {} | 1000000 | 0.000884 | [] |

| 41 | 2011-03-09 | 1000000 | {} | 1000000 | 0.000420 | [] |

| 42 | 2011-03-10 | 1000000 | {} | 1000000 | -0.017551 | [] |

| 43 | 2011-03-11 | 1000000 | {} | 1000000 | -0.010025 | [] |

| 44 | 2011-03-14 | 1000000 | {} | 1000000 | 0.004787 | [] |

| 45 | 2011-03-15 | 1000000 | {} | 1000000 | -0.018069 | [] |

| 46 | 2011-03-16 | 1000000 | {} | 1000000 | 0.013806 | [] |

| 47 | 2011-03-17 | 1000000 | {} | 1000000 | -0.015730 | [] |

| 48 | 2011-03-18 | 1000000 | {} | 1000000 | 0.005813 | [] |

| 49 | 2011-03-21 | 1000000 | {} | 1000000 | -0.002667 | [] |

| 50 | 2011-03-22 | 1000000 | {} | 1000000 | 0.004942 | [] |

| 51 | 2011-03-23 | 1000000 | {} | 1000000 | 0.013021 | [] |

| 52 | 2011-03-24 | 1000000 | {} | 1000000 | -0.004155 | [] |

| 53 | 2011-03-25 | 1000000 | {} | 1000000 | 0.013263 | [] |

| 54 | 2011-03-28 | 1000000 | {} | 1000000 | -0.001188 | [] |

| 55 | 2011-03-29 | 1000000 | {} | 1000000 | -0.009905 | [] |

| 56 | 2011-03-30 | 1000000 | {} | 1000000 | -0.000583 | [] |

| 57 | 2011-03-31 | 1000000 | {} | 1000000 | -0.010071 | [] |

| 58 | 2011-04-01 | 1000000 | {} | 1000000 | 0.015339 | [] |

| 59 | 2011-04-06 | 1000000 | {} | 1000000 | 0.011714 | [] |

| ... | ... | ... | ... | ... | ... |

868 rows × 6 columns

perf = qp.perf_parse(bt)

out_keys = ['annualized_return', 'volatility', 'information',

'sharpe', 'max_drawdown', 'alpha', 'beta']

for k in out_keys:

print '%s: %s' % (k, perf[k])

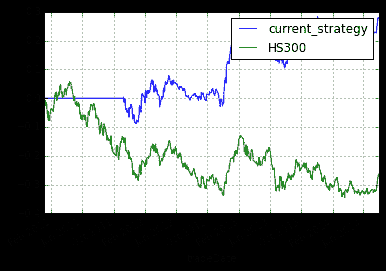

annualized_return: 0.0806072460858

volatility: 0.121542243584

information: 0.967129870018

sharpe: 0.344919139631

max_drawdown: 0.100359317734

alpha: 0.0876204656402

beta: 0.392712356147

perf['cumulative_return'].plot()

perf['benchmark_cumulative_return'].plot()

pylab.legend(['current_strategy','HS300'])